Although stocks have recovered somewhat, the six consecutive days of losses have many investors asking, "Is this a bear market?"

In that span, the Dow Jones Industrial Average shed 1,878.74 points, or 10.7%. That technically qualifies as a stock market correction. Bear market territory is considered a drop of 20% or more.

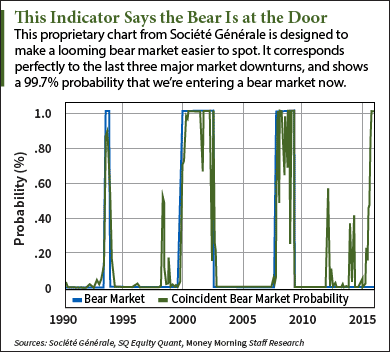

A chart from French multinational bank Société Générale S.A. (OTCMKTS ADR: SCGLY) says yes, this is a bear market. And very convincingly, too - it actually indicates there's a 99.7% chance we're already in a bear market.

A chart from French multinational bank Société Générale S.A. (OTCMKTS ADR: SCGLY) says yes, this is a bear market. And very convincingly, too - it actually indicates there's a 99.7% chance we're already in a bear market.

The chart was created earlier this year by SocGen's head of quantitative equity research, Andrew Lapthorne. While the details are proprietary, it uses "macroeconomic and fundamental equity variables."

That's a mouthful, but backtesting has shown it's uncannily accurate. The chart corresponds perfectly to the last three major stock market downturns.

"When you view the U.S. equity market through the prism of investment-style performance," Lapthorne wrote in a note earlier this month, "you can see that investors are positioning themselves exactly as you would expect if faced with an economic deceleration."

This week, SocGen's global strategist, Albert Edwards, pointed to Lapthorne's chart as he made his case that this is a bear market.

"Most investors only realize the economy is in a recession well after it has begun. The same is true of an equity bear market," Edwards wrote in an Aug. 27 note to clients.

Money Morning Capital Wave Strategist Shah Gilani said the prospect of a bear market, while distressing for many, does serve a purpose.

"What the markets need is a good, long flushing-out," Gilani said. "They need to squeeze out excesses built into artificially inflated equity prices and bond prices."

That's good - as the SocGen chart isn't the only evidence telling us this is a bear market...

Is This a Bear Market? It's Starting to Look That Way

- The bull market that started in 2009 reached its sixth birthday in March, and became the third-longest in history as of May. The average bull market lasts about four years.

- The Standard & Poor's 500 Index formed a "death cross" today (Friday). That's when the 50-day moving average falls below the 200-day moving average. Technical analysts consider it a bearish indicator.

- The U.S. Federal Reserve is planning to raise interest rates, which will reduce the cheap money that has helped fuel the stock market's rise.

- A China stock market crash and increasingly worrisome signs of weakness in China's economy have already started to affect emerging economies. It's true that China's direct impact on U.S. markets will be slight. But ripples from damaged emerging economies and other major trading partners with China will eventually reach U.S. shores.

While investors can't be sure if this is a bear market, the increasing probability that we could have one means everyone should be taking precautions.

And that does not mean sitting on the sidelines.

"Running for cover may feel good in the short term, but doing so is totally counterproductive to building 'total wealth,'" said Money Morning Chief Investment Strategist Keith Fitz-Gerald.

Instead, here's what to do...

How to Thrive in a Bear Market

Fitz-Gerald recommends investors use trailing stops as protection against bear market losses. Trailing stops are calculated as a percentage of the purchase price. If the stock falls below that point, it triggers a sell order.

But a trailing stop will rise as the stock price rises, locking in more of your gains in the event the price reverses.

"Thanks in part to our trailing stop discipline, we have something other investors don't have - the luxury of calmly, coolly evaluating what's happening while deliberating our next steps," Fitz-Gerald said.

And Gilani notes that if it turns out we are in a bear market, "it's not too late to take profits, if you still have them. And it's not too late to hedge against further downside moves, or to make money if stocks have a lot further down to go, which I think they do."

One way to make money in a bear market, he said, is to invest in inverse exchange-traded funds (ETFs).

"There's always a place to make money... always," Gilani said.

Two of his top picks are:

- ProShares Short Dow30 (NYSE Arca: DOG), an inverse ETF that correlates to the Dow Jones Industrial Average. It's up 6% in the last month.

- ProShares Short QQQ (NYSE Arca: PSQ), an inverse ETF that tracks the performance of the Nasdaq 100 Index. It's up 5% since Aug. 18, when the recent downturn started.

Follow me on Twitter @DavidGZeiler.

What Jim Rogers Is Doing: Legendary investor Jim Rogers had his attention focused elsewhere during the recent stock market downturn, a sector most investors have written off - commodities. He's optimistic despite the protracted declines in most commodity prices, especially oil. Here's why Jim Rogers believes commodities are a solid bet right now...

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.