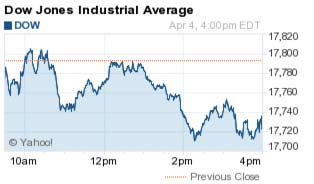

Once again, the markets were digesting statements by the U.S. Federal Reserve, as the timing of the next interest rate hike comes into focus. The Dow Jones Industrial Average lost some ground today as investors await statements from the head of the Minneapolis Federal Reserve Bank and the Dallas Federal Reserve bank later this evening.

Here's what you need to know about the markets on Monday, April 4, 2016.

First up, check out the results for the Dow Jones, S&P 500, and Nasdaq:

First up, check out the results for the Dow Jones, S&P 500, and Nasdaq:

Dow Jones: 17,737.00; -55.75; -0.31%

S&P 500: 2,066.13; -6.65; -0.32%

Nasdaq: 4,891.80; -22.75; -0.46%

Now, here's the top stock market news today...

DJIA Today: Factory Fumbles, Apple Upgrade, and Facebook Rallies Again

Shares of Apple Inc. (Nasdaq: AAPL) jumped 1% after receiving an upgrade from European banking giant Credit Suisse Group AG (NYSE ADR: CS). The bank added the technology giant to its U.S. Focus List and gave the stock a price target of $150 per share.

Boston Federal Reserve President Eric Rosengren said he thinks the central bank should start tightening monetary policy sooner than later. Today, he suggested that futures markets - which don't project a rate hike until September - don't provide the best argument for the timing of a rate hike. He also said risks from abroad are easing, which makes us wonder if he has read a newspaper lately. That said, Minneapolis Fed President Neel Kashkari and Dallas Fed President Rob Kaplan will speak this evening.

WTI crude oil prices hit a one-month low as traders evaluated statements from the Organization of Petroleum Exporting Countries (OPEC). The global oil cartel is set to meet in Qatar in two weeks to discuss a potential freeze in production to support crude prices. However, Saudi Arabia has thrown a wrench into plans by stating their unwillingness to engage in the freeze unless Iran joins the cause. WTI crude prices fell 3% to $35.70 - the lowest level since March 3. Meanwhile, Brent crude was off 2.5% to $37.69.

On the economic front, U.S. factory goods demand slipped 1.7% in February, renewing concerns about the ongoing health of the U.S. economy. The U.S. Commerce Department also downwardly revised its January figure, as traders begin to worry about first-quarter GDP growth. According to economic data, factory orders have declined in 14 of the last 19 quarters.

But the big talk today was Facebook Inc. (Nasdaq: FB). Shares of the social media giant slipped 3% after a report from Deutsche Bank AG (NYSE: DB) analyst Ross Sandler predicted the firm will see the stock decline after it announces its first-quarter earnings report. However, he also said the stock will rise to $145 per share within the year. That's more than 30% higher than the current price, which makes us wonder what traders are thinking. Facebook is a stock that you want to own for the long term, especially as it continues to play a role in the virtual reality market.

Now, let's look at the day's biggest stock movers...

Top Stock Market News Today

- The deals keep coming. Shares of Virgin America Inc. (Nasdaq: VA) surged 41.7% after news broke that the company will be purchased by Alaska Air Group Inc. (NYSE: ALK) for roughly $2 billion.

- Shares of SunEdison Inc. (Nasdaq: SUNE) cratered again today. The firm's stock slumped 51% on news that the alternative energy firm is close to filing for bankruptcy.

- Groupon Inc. (Nasdaq: GRPN) received a solid bump today. Shares rose 9.4% after the firm announced an investment of $250 million from Atairos. The daily deals site will partner with Comcast Corp. (Nasdaq: CMCSA) as part of the investment.

- Shares of Edwards Lifesciences Corp. (NYSE: EW) rallied 16.8% after the company announced its heart-valve implant showed positive signs and was a better alternative than open surgery. The stock received multiple upgrades after the news.

The Shocking Forecast for Oil Prices in 2016: Crude oil prices plunged in 2015, but our forecast points to a turnaround this year that will send the price of oil higher. Don't miss our full-year target and the key developments that will move oil prices in 2016. Read more...

Follow Money Morning on Facebook and Twitter.

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.