My inbox has been flooded by Apple Inc. (Nasdaq: AAPL) headlines ever since the iPhone 7 was released on Sept. 7 - yours probably has been, too.

After all, the stock rallied higher for 11.6% gains... in just one week.

That left investors who already own the stock craving more. And those who don't are wishing they got in when they had the chance.

But the stock has fallen a bit from last week's highs, leaving investors wondering if it's too late to cash in on Apple stock.

Don't worry... it's not.

And here are three very different ways you can profit...

How AAPL Stock Gained 11.6% in One Week - and Three Ways You Can Profit

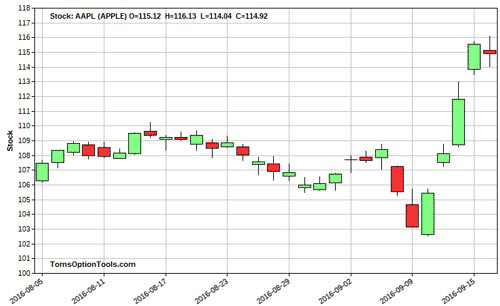

When you look at the short-term price chart below for AAPL stock, you can see that only two Fridays ago it closed just a hair over $103.

That's nearly a 12% gain in one single week!

There are many reasons for the surge in the stock, but one of the largest contributors is the sale of its latest release, the iPhone 7.

Don't Miss: America's Favorite Soup Is in Trouble - and This Is the Best Time to Profit

Apple has said that the volume of pre-order sales was so high that stores it sold out of all colors of the iPhone 7 Plus handsets and the jet-black iPhone 7 phones. For example, on Sept. 13, T-Mobile reported a record number of pre-order sales... to the tune of four times the pre-order sales of the iPhone 6, which was released in September 2014. And Sprint has also reported seeing four times the volume of pre-order sales for the iPhone 7 versus the iPhone 6. In a three-day span alone, pre-orders were up by over 375%.

And with the success of the iPhone release making headlines almost every day since coming out, more and more investors are jumping on the opportunity to cash in on the stock - driving it higher and higher.

New Coverage Plans

To accommodate high demand for the iPhone 7, Apple is now offering the iPhone Upgrade Program, which allows consumers to upgrade to a new device after just six months of payments (instead of 12) on the 24-month installment plan.

Apple is also now providing consumers with the flexibility to select and switch their carriers so that they're no longer married to the same multi-year contract after activating their iPhones. For example, there's the AT&T Next plan that comes with the purchase of an iPhone 7 or 7 Plus and allows two installment plans - with three different ways to upgrade. Sprint is also on board, with its iPhone Forever program, which allows consumers to upgrade their phones every time a new iPhone is released. And T-Mobile already offers a low-cost feature called Jump! On Demand, which enables consumers to upgrade their phones three times within a rolling 12-month period.

And with no more contracts and a variety of upgrade options across carriers, it's not surprising that more and more people are switching to Apple - especially when looking at its number one competitor...

Samsung's Faux Pas

As I'm sure you've seen by now, Samsung Electronics Co. Ltd. (OTCMKTS: SSNLF) was forced to recall the Samsung Galaxy Note 7 because of fires and explosions caused by the overheating of the smartphone's lithium-ion battery. Now Samsung, naturally, has been heavily marketing its "Galaxy S7 with free virtual reality headset," and some service providers, like Verizon, have started processing orders again for the Galaxy Note 7.

But the world's largest manufacturer of cell phones isn't in the clear by any means, and is currently facing at least one lawsuit (and likely more to follow) over burns and other injuries caused by the device exploding in consumers' hands. And unfortunately, consumer loyalty to Samsung is taking a pretty big hit over its response to the crisis.

Get Our Best Wealth-Building Ideas: Money Morning's top 5 investment reports to grow your money like never before are right here - and they're absolutely free. Read more...

Now, whether or not you own a Samsung phone, the fact of the matter is... this major blunder decimated the negative attention Apple was getting for the removal of the headphone jack in the iPhone 7.

And that's exactly what Apple needed to boost its sales and drive the stock higher.

But it may not last...

Why AAPL May Pull Back from Last Week's Highs

My contention is that the stock may have shot up too far too fast - and a pullback in profit-taking may soon ensue.

Here's why...

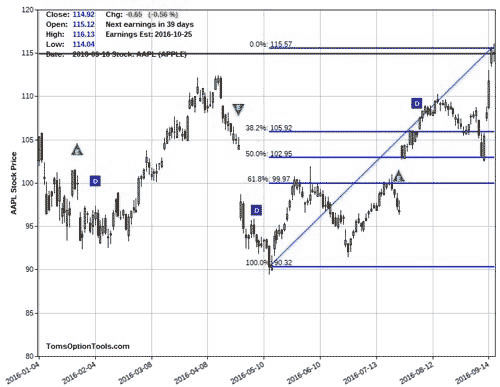

There's a technical analysis tool that identifies a pullback in the trend of a stock before that trend then resumes, resulting in a series of higher highs and higher lows (or lower lows and lower highs) before the trend continues. Soon I'm going to show you exactly how this tool works. But in the meantime, it's telling me that we're looking at a retreat from AAPL's surge.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

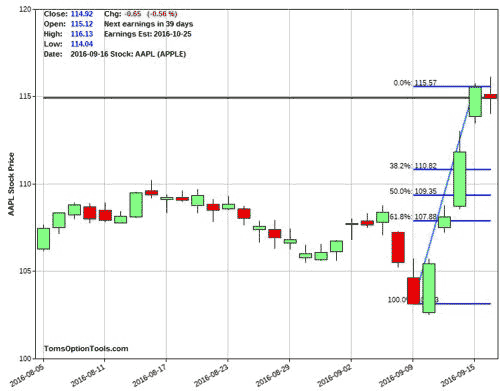

In the chart below, you can see the lowest to the highest point of AAPL's price movement so far this year. The support is right around $90, while the resistance is around $115.

And in the following chart, you can see the low to high points in AAPL's price movement during last week's rally.

Here, you can see the support right around $100, with the resistance at around $115.

And what this tool is telling me is that we could be looking at a pivot in the stock price down to at least $110 before it bounces back and continues higher.

But don't worry... you've still got time to get in on the profits.

Three Ways to Play Apple Stock Right Now

Apple Stock Strategy No. 1: Buying the Stock

This is the probably the most obvious (and common) way you can take advantage of the stock's upward price movements.

But while this method can be rewarding if it works in your favor, it can also be extremely expensive. For example, AAPL costs over $113 as of the time I'm writing. That means you'd need to shell out, at the very least, over $113 just to buy one single share of stock. And you'd better hope that the stock keeps moving higher, because if it doesn't, you're looking at losing all of the money you spent.

Also, while timing your exits can be tricky with any strategy, selling the stock you own too early could really come back to haunt you...

Take Ron Wayne, for example, who was one of the three founders of Apple (along with Steve Jobs and Steve Wozniak). Wayne drew the first-ever Apple logo, wrote the original partnership agreement, and the first Apple manual. When the three founded the Apple Computer on April 1, 1976, Wayne owned shares of the company for a mere $0.10 per share. Less than two weeks later, he sold all of his stock for $800. But had he held onto those shares, they'd be worth $35 billion today.

Apple Stock Strategy No. 2: Buying Long-Term Equity AnticiPation Securities (LEAPs)

LEAPs are long-term stock options with expirations as far out as two and three years. LEAPs allow you to take part in a price increase without the high costs of buying the stock outright. And since LEAPs have much longer expirations, you've got much more time for the trade to move in your favor.

That said, this strategy could still be a bit pricey because you're essentially paying for that extra time. And the longer you have until expiration, the more you pay. Plus, there's always the chance of the trade not working in your favor. So you could spend more for more time on a trade that ends up being unsuccessful.

Apple Stock Strategy No. 3: Trading Spread Options

A "spread option" involves trading more than one option at the same time to lower the overall cost of and risk of your trade.

Now one thing to keep in mind when it comes to spreads is that with lower risk comes lower reward. But since you're leveraging your cost and risk, you're also increasing the probability of profits. And that means that even though your reward potential may be lower, you're likely to have more profitable trades than if you used a higher-risk strategy.

In fact, members of my Money Calendar Alert service have already had 15 opportunities this year to bank triple-digit profits - all using spread options.

So if you want to get in on the Apple action but have concerns about a possible pullback in its upward momentum, a spread trade could be your best option (pun intended).

This Is the Best "Retirement Stock" of 2016... And the good news is, it's trading for "pennies." But it won't be for long... its revenue is set to surge 4,709%. Learn the details of this $5 stock today while it's still "on sale." Read more...

Follow Money Morning on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.