The price of gold today (Friday, June 23) is on track for its highest close in nine days as the metal climbs out of its recent Fed-induced gully. It's up 0.7% and trading at $1,258 per ounce - the highest level since June 14.

Investors are mostly buying into gold today because of the recent decline in riskier assets like stocks. Since Tuesday, June 20, the Dow Jones Industrial Average is down nearly 1% to 21,351.31 as the market reacts to falling oil prices. WTI has plunged to its lowest levels of the year this week, falling 4.1% to $42.62.

All of this has led investors to seek safe-haven assets like gold to hedge their portfolios.

But despite today's gain, there's no denying that gold's been struggling for the better part of the last two weeks.

Since peaking at $1,293 in early June, gold prices are down 2.7% to their current level. The only reprieve has been a short stall around $1,267 in the days preceding the Federal Reserve's rate hike on June 14.

The most obvious reason behind the decline has been the rising U.S. dollar. Since bottoming out on June 6 - the same day gold peaked - the U.S. Dollar Index (DXY) has managed a reasonable show of strength. It has climbed from 96.53 to 97.40 since that date.

Of course, it's easy to look at the Fed's rate hike and say the hike has been supporting the dollar. And that's likely true. But take more than a cursory look at the dollar's technical indicators, and you can see that it had become oversold, making a rally of sorts unsurprising.

We'll look at these gold price drivers and how they'll influence our bullish price target in 2017 in just a bit. First, let's look at the metal's pivotal past week...

Gold Prices Set for Slight 0.3% Gain in the First Week After Fed Meeting

After settling at $1,253 on Friday, June 16, the gold price opened Monday, June 19, lower at $1,251. Like the previous week, gold headed steadily south but at a faster clip, to close 0.7% lower at $1,244.

Tuesday brought continued weakness, though it somewhat subsided. The price of gold opened at $1,245 but dropped to $1,243 by the close for a 0.2% loss. That was the lowest settlement since May 16.

As it turned out, the DXY's peak of 97.85 that day coincided with gold's bottom for the week...

On Wednesday, June 21, the tides started turning around for gold prices. It was a welcome sign of life for the precious metal after reaching a five-week low the day before. Gold started the day higher at $1,245 and steadily inched toward $1,246 for a 0.2% gain by the close.

Overnight into Thursday morning, gold bounced up to open at $1,253. The DXY kept backing off its Tuesday high, allowing the price of gold to reach $1,250 for a 0.3% gain on the day.

And the gold price today is up 0.7% to $1,258, putting the metal on track for a weekly gain of 0.3%. This would be its first weekly gain in three weeks.

Must See: An incredibly rare gold anomaly is shaping up in the markets as we speak -- one that has occurred ONLY twice in the past 20 years. And it's about to happen again. Details here...

I expect gold prices to keep moving higher from here. Although there may be some short-term pullbacks, like the one we've seen over the last two weeks, the long-term picture is fundamentally bullish.

Here are my bold gold price targets for the rest of 2017...

My Outlook for the Price of Gold in 2017

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Let's examine more closely the technical factors moving the U.S. dollar, which will help us forecast what may lie ahead.

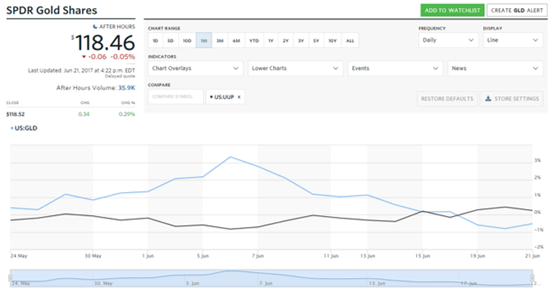

First, have a look at the near-perfect inverse relationship between gold and the dollar over the past month...

This is why I say gold's weakness since early June is a reflection of the dollar's strength. That means what happens next for the dollar may be the key to gold's moves this year.

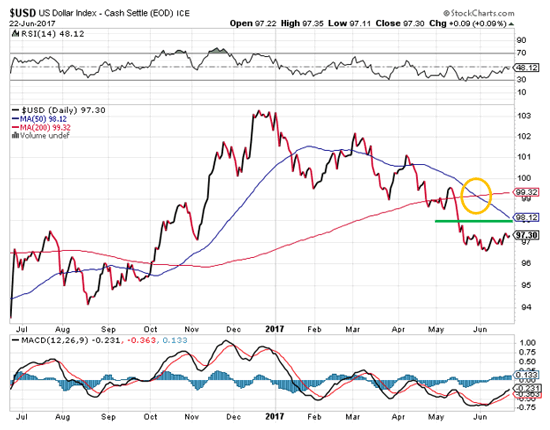

Another thing to note is the dollar's average movements, which you can see in this chart below...

The first thing to note is that in late May the DXY triggered a bearish "death cross" (orange circle) when the 50-day moving average (blue line) crossed downwards over the 200-day moving average (red line). Given the action in the Relative Strength Index and MACD momentum indicators, it's possible that the DXY became somewhat oversold.

So we could be in for a bit more strength, but given the marked trend lower since the start of the year, I think the dollar is likely to bump into overhead resistance around the 98 DXY level, where the 50-day moving average currently sits.

If that pans out, the gold price could see some headwind. But once the dollar resumes its trend lower, gold is likely to get a boost and resume its rally higher.

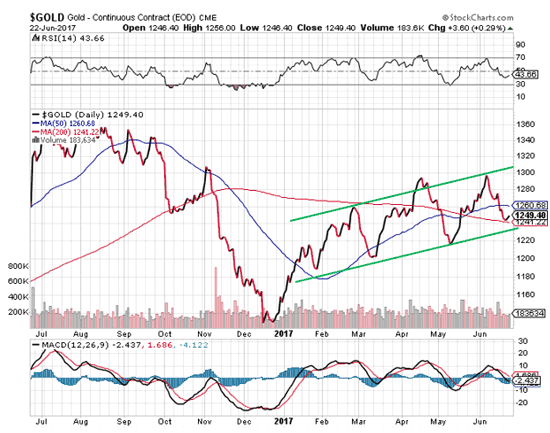

As this chart below shows, gold has already been on a long-term rise that will likely continue...

In the meantime, I'll be watching for gold to form a new bottom. That may have already happened this week. If instead it proves to go lower, the $1,240 level would keep it within its current upward trend line and help to form a bullish "higher low."

With that in mind, $1,300 still looks achievable over the next few months. That would be a 3.3% rise from the current price of $1,258. But I'd expect to see that soon surpassed as gold manages to make a new bullish "higher high."

From there, I expect $1,400 gold by the end of 2017, marking an 11.3% gain from the current price.

Up Next: The 4 Best Silver Investments of 2017

Follow Money Morning on Facebook, Twitter, and LinkedIn for more investment analysis and breaking news stories.