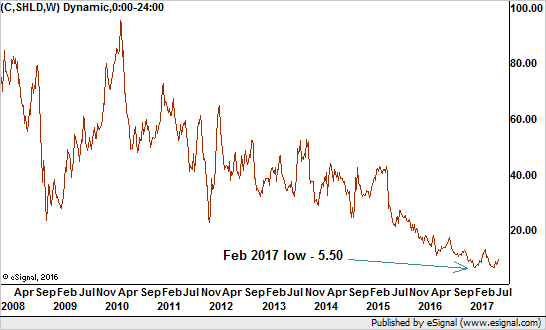

Sears stock has rebounded more than 43% in the last month, but that does not mean this stock is turning around. Quite the opposite.

We still think Sears is headed toward bankruptcy. If you own it, get out. And if you think management can pull off a miracle, forget it. They can't.

We still think Sears is headed toward bankruptcy. If you own it, get out. And if you think management can pull off a miracle, forget it. They can't.

Money Morning Capital Wave Strategist Shah Gilani told readers back in May about Sears' epic downfall. He even outlined a strategy to profit as Sears stock "lurches towards its deathbed." And despite the stock's recent rally, if you'd followed Gilani's plan, you'd still be up double digits.

All the reasons for this bearishness are still very much intact. Here's what he told you in May:

"Sears Chair and CEO Eddie Lampert's financial engineering experiment clearly has failed. He 'Frankensteined' Kmart and Sears together to form what can only be called a retail abomination. Sears Holdings has lost $10.4 billion since 2011. Excluding 'one-time charges' and 'events,' the loss is $4.57 billion."

Trending: The "Retail Ice Age" Investment Strategy That Everyone Is Missing

Since the beginning of 2012, Sears has seen its sales fall 44%, and the company has reported 21 straight quarters of losses.

Gilani also points out that same-store sales in the last quarter of 2016 (including the holiday shopping season) fell 10.3%.

The company is also bleeding cash. In the summer of 2015, SHLD had $1.8 billion in cash. By the end of 2016, it was down to $258 million.

Back in January, the company sold its iconic Craftsman brand to Stanley Black & Decker Inc. (NYSE: SWK) for $900 billion, although not all of it was in an upfront payment. Sears will still carry the brand in its stores, but now they must compete with other retailers to make any profit from it. And guess who else carries it now? Amazon.com Inc. (Nasdaq: AMZN). Great for Stanley shareholders, but not so much for Sears shareholders.

After its terrible "softer side of Sears" push into clothing, the meat of its business remained in hard goods such as Craftsman tools, Kenmore appliances, and Die-Hard auto batteries. If you're keeping score, that's one down, two to go.

Selling off a core business usually means trouble. The company clearly needs cash, so much so that this week CEO Lampert gave the company $200 million from his own hedge fund. The stock shot up 12% when the news broke July 17.

The stock jumped another 14% July 20 on news that Kenmore appliances would be available on Amazon. And they will be "Alexa enabled," allowing them to be controlled remotely via Amazon's virtual personal assistant. The partnership marks Amazon's move into the large appliance business, one of the few areas of retail where it has yet to dominate.

And while the partnership has some investors bullish, it's no reason to buy shares of Sears stock...

Sears Stock Is Doomed Despite Recent Uptick

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Sears now becomes another product supplier to the Amazon juggernaut. The benefits to Sears come through increased distribution and Sears Home Services, as it will provide delivery, installation and extended product protection for all Kenmore goods sold through Amazon.

Sears now becomes another product supplier to the Amazon juggernaut. The benefits to Sears come through increased distribution and Sears Home Services, as it will provide delivery, installation and extended product protection for all Kenmore goods sold through Amazon.

Analysts now speculate that the deal could be a precursor to Amazon buying the Kenmore brand outright. Two down, one to go. Sears is fast becoming a hollow corpse. Even employees are up in arms, as one filed suit last week for holding Sears stock in its retirement plan.

Gilani recommended readers short SHLD stock when he wrote to them in May. Readers who took his advice made a nice 39.35% gain in just a little over one month by shorting Sears around $10.55 and again at $11.00, $13, and $14.

Investors who remain bearish on SHLD stock can buy put options that expire early in 2018 and ride this zombie into the land of profits. At the very least, all investors should avoid buying into the Sears "rally" we've seen in recent weeks.

Up Next: The Only Way to Make Money Off Blue Apron's Inevitable Demise