Oil prices today (Tuesday, Sept. 19) are trading above $50 a barrel, which puts oil on track for its highest closing price since July. And we predict oil prices will head even higher before the end of the year, too...

WTI crude oil prices are trading at $50.26 a barrel today and are up 3.5% since just last week, when they opened at $48.23 on Thursday.

Oil prices continue to rebound after Hurricanes Harvey and Irma wiped out demand across the southeast United States. The destruction of pipelines, refineries, and commerce across Florida and the Gulf Coast region meant oil pumped out of the ground was being stored instead of used. That boosted supplies and lowered prices. Commercial crude supplies rose 2.2% between the weeks of Aug. 25 and Sept. 8.

Oil prices fell 4% between Aug. 25 and Aug. 30 as Hurricane Harvey made landfall in Texas, and they fell 3.2% between Sept. 7 and Sept. 12 as Irma barreled through the Caribbean and Florida.

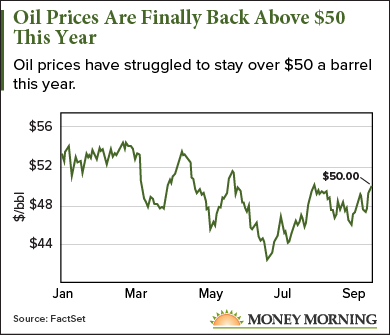

Oil prices have struggled to stay above the $50 a barrel mark this year, despite OPEC renewing its oil production cut in May.

But our oil price forecast shows oil prices will continue to rise in 2017, and one important oil price indicator shows it's about to happen soon...

Why Oil Prices Today Are Rising Again

Oil prices started the year with highs above $54 a barrel in January and February, but sunk below $50 a barrel this summer. An excess of oil supply weighed down oil prices, but the supply is finally dwindling...

Yesterday, the International Energy Agency (IEA) released its monthly report showing the world's oil supply dropped by 720,000 barrels a day in August. This was the first drop in supply in four months.

And now, OPEC can finally claim that their production cut deal is working.

New Oil Tax Set to Cost Americans at the Pump: Paul Ryan is set to introduce a new tax to Congress, and it will cost Americans an additional 30 cents or more per gallon at the pump. Click here to find out more...

Saudi Arabia has been pressuring OPEC members to live up to their production cap first signed in November 2016 and renewed in May. The Saudis advocate restricting oil exports among OPEC members if oil prices don't rise. Saudi Arabia could propose an export-monitoring regime at the Sept. 22 meeting in Vienna. That appears to have galvanized OPEC members into adhering to the agreement.

OPEC's compliance rate for the agreement jumped from 75% in July to 82% in August. The 11 non-members participating in the deal achieved 100% compliance. That led to OPEC's production falling by 79,100 barrels a day in August. OPEC's production is down about 1 million barrels since last year.

But that wasn't the only bullish news for oil prices...

Weekly oil production in the United States dropped nearly 5% between August and the first half of September. The United States averaged 9.5 million barrels of oil a day in August, but it is averaging 9.1 million barrels a day through September.

U.S. crude oil stocks are also dropping. From the first week of June to the first week of September, U.S. supply fell a little more than 2%. In July, crude stocks fell below 2 billion barrels for the first time since January 2016.

And there's even more bullish news for oil demand, too...

The same IEA reported its oil forecast for global demand grew another 1.6 million barrels a day. That's a jump of 6.6% over its forecast in July and despite weakened demand in the United States thanks to Hurricanes Harvey and Irma.

Oil traders responded to the positive news by bidding crude prices over $50 a barrel.

But our oil price prediction says WTI prices are going even higher in 2017. And we've uncovered one indicator that shows oil will hit our price target very soon...

One Reason for Our Bullish Oil Price Target for 2017

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Money Morning Global Energy Strategist Dr. Kent Moors says WTI oil prices could gain another 8% this year, reaching a potential high of $54 a barrel.

Moors expects crude to reach a range between $52 and $54 a barrel this year.

While Moors says the realities of OPEC's oil production cut and rising demand will boost oil prices, he says there's another key indicator showing WTI prices are heading higher.

That's the spread between Brent crude prices and WTI crude prices...

You see, Brent is the benchmark for international oil prices, while WTI is the benchmark for U.S. oil prices. And Brent typically trades at a higher price than WTI, because it's the international measure for oil prices. The higher demand for Brent contracts boosts its price over WTI, but it also means when global oil sentiment changes, it's seen first in Brent prices.

While Brent crude typically trades higher than WTI, Moors says that the growing spread between Brent crude and WTI is a sign that WTI is heading higher soon. In other words, since Brent prices move first, WTI is soon to follow.

At the end of August, Brent traded more than 8% higher than WTI for the four consecutive days, the first time that happened in two years. Today, Brent crude is trading 11.5% higher than WTI.

Moors says the last time Brent traded a double-digit percentage higher than WTI, the price of WTI spiked.

"All of this seems to indicate that a rise in the spread, occurring early in a new process, may well be a harbinger of a higher overall pricing dynamic moving forward," Moors said.

In fact, Brent crude prices have already hit Moors' 2017 price target. That means his WTI price target of $52 to $54 won't be far behind.

Most Will Miss Out on This "10X Your Money" Opportunity

It's the last place anyone's looking to make money right now. And they couldn't be more wrong.

Because what these naysayers are missing is that, over the past year or so, certain stocks in this sector rocketed 40 times higher in just 12 months... 18 times higher in 9 months... and 19 times higher in 10 months... just to name a few.

This may be the ultimate contrarian play right now... and 10X profits could be just the beginning.

Follow Money Morning on Twitter @moneymorning, Facebook, and LinkedIn.