Silver prices are finally on the rise again, after their price weakness appears to have finally ended over the last trading week. Since my Oct. 31 update, when silver reached a bottom of $16.69, the metal has rebounded 2.6%, to $17.12 today (Tuesday, Nov. 7).

The biggest catalyst this week is uncertainty surrounding Saudi Arabia and the kingdom's arrest of 11 high-profile princes and four ministers. Prince Mohammed bin Salman - the son of King Salman - is widely seen as the power behind his father's throne. While the government cited efforts to purge corruption as the reason for the arrests, they appear to be Prince Mohammed's move to consolidate his power.

The news not only pushed oil prices up nearly 3% yesterday (Monday, Nov. 6), but it also gave the silver price a 2.4% boost. That gain outperformed gold's 1% gain and demonstrated the relative "undervaluation" of silver compared to gold right now.

And as much as gold stocks remain an incredibly undervalued sector, silver stocks are arguably even cheaper relative to silver. To me, that indicates an incredible buying opportunity is forming for silver right now.

While we may see day-to-day volatility, I think the price of silver is set for an overall rally through the end of the year. In fact, I predict it could gain as much as 19.8% before the end of December.

Before I dive deeper into my forecast, here's a recap of the metal's rebound in the last week...

Silver Prices Climb 2.6% Over the Last Week (Oct. 31 - Nov. 7)

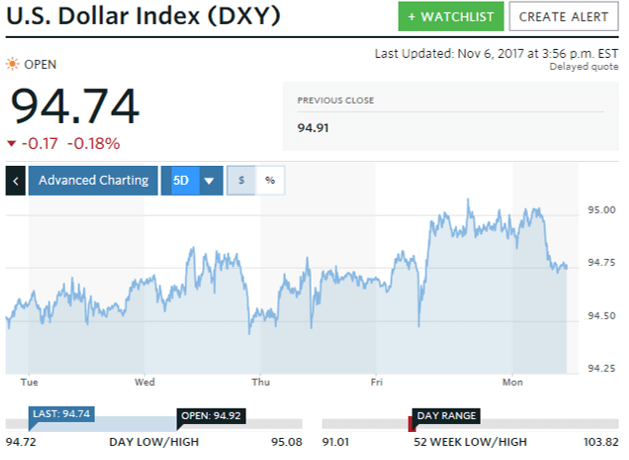

After falling to a three-week low of $16.69 on Tuesday, Oct. 31, the silver price saw a stunning rebound on Wednesday, Nov. 1, after the U.S. Federal Reserve left interest rates unchanged. Despite the U.S. Dollar Index (DXY) rising from 94.55 to 94.81 that day, silver still rallied 2.9% to close the day at $17.18. That was the biggest one-day gain since Aug. 9.

The price of silver pulled back a bit on Thursday as investors focused their attention on the stock market. The Dow Jones climbed 0.3%, which dragged silver 0.2% lower on the day to settle at $17.14. Silver's losses came amid a small decline in the DXY, dropping from 94.81 to 94.69 over the course of the session.

This chart shows the DXY's performance over the last week...

On Friday, Nov. 3, silver prices plunged as the DXY closed at its highest level since July 17. The metal opened at $17.07, then kept falling from there to close the day at $16.83. That marked a 1.8% loss for the session.

The silver price kicked off the new week with a rally yesterday (Monday, Nov. 6) as the DXY pulled back from the 95 level to close at 94.75. This - combined with uncertainty surrounding the arrests in Saudi Arabia - urged investors to buy safe-haven metals like silver. By the end of the session, silver prices were up 1% to $17.24 - the highest close since Oct. 19.

Urgent: Executive Editor Bill Patalon just saw something on his precious metals charts he's only seen twice in 20 years. He calls it the "Halley's Comet of investing" - and it could lead to windfall profits. Read more...

But the price of silver today (Tuesday, Nov. 7) is retreating from yesterday's three-week high. It's currently down 0.7% and trading at $17.11.

Silver's Oct. 31 settlement at $16.69 was the lowest since Oct. 5, and it looks like it could be a bottom considering last week's rebound. I think silver prices could keep pushing higher from here, even if they continue to see day-to-day swings.

This is why I think the metal could rebound another 19.8% by the end of 2017...

My Silver Price Forecast for the Rest of the Year

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

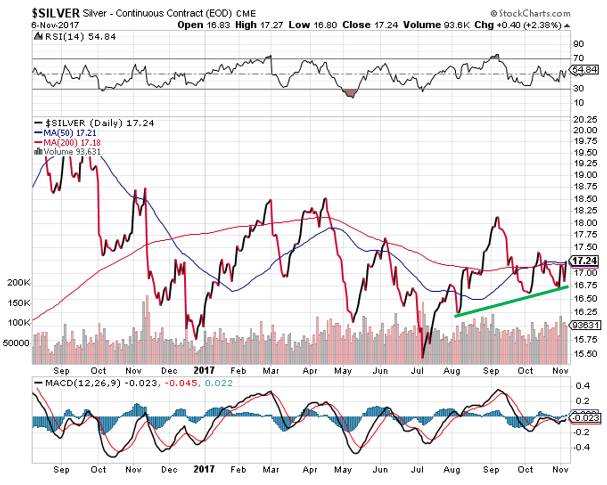

Although silver has been struggling since its Sept. 12 peak at $18.12, the metal has been consolidating and building a base level between $16.25 and $16.75 since August...

There are two positive moves to take note of...

First, the silver price has been creating a series of higher lows since hitting its 2017 low on July 7. Second, yesterday's close is just above the 50-day and 200-day moving averages of $17.21 and $17.18, respectively. That's a bullish indicator, and this momentum means the metal could soon make a quick run to $18.

Another area to watch is silver mining stocks, represented by the Global X Silver Miners ETF (NYSE Arca: SIL) in the chart below.

As you can see, silver mining stocks are lagging behind the silver price right now...

Since mid-October, Silver Miners have tumbled 8% and broken down below its rising slope of higher lows since July. Any further weakness could mean a test of last December's low of $30.84. But volume has dropped off so much that we could already be seeing a bottom for sentiment. Either way, the current price is certainly at a bargain level.

Silver mining stocks outperformed the silver price by a huge 113.3% in the first half of 2016, but the stocks have clearly corrected since then. The bottom in sentiment that I think we're seeing right now indicates silver stocks could explode higher as we reach the point where there's no one left to sell.

Once silver gets back above $18, its next targets will be $18.50, $20, and $20.50 by the end of the year. If it hits that last $20.50 target, it would mark a strong gain of 19.8% from today's price of $17.11.

Up Next: Rare Gold Anomaly

Money Morning Executive Editor Bill Patalon just caught something on his gold charts that he's only seen twice in the past 20 years. A $13 billion gold anomaly he calls the "Halley's Comet of investing."

It's very rare, and fleeting, and Bill sees things lining up perfectly to bring some very sizeable precious metal profits to well-positioned investors.

Click here to check out his research...

Get On the Path to Greater Wealth: When it comes to making money in the market, "getting in" early - before a stock begins to make its decisive move - is the single biggest factor to your success as an investor. Quickly buying Apple after the June 2013 sell-off, for instance, could have doubled your money. Moving on Valeant the same day we recommended our big "negative bet" against it would've booked you a remarkably fast 700% return. That's why we've introduced Money Morning Profit Alerts. This new, free service lets you choose what investing areas you want to follow - and makes sure you get alerted to news from that sector as soon as we publish it. It means no more waiting. No more searching. No more missing out. It's easy to get started - just go here.

Follow Money Morning on Twitter @moneymorning, Facebook, and LinkedIn.