Last week, during her semi-annual address, U.S. Federal Reserve Chair Janet Yellen told Congress that they see a tapering off of interest rate hikes for the year. Right after the news broke, the Dow gapped up to its all-time intraday high.

The question becomes whether the markets have run too high too fast - and if they have the stamina to sustain these prices.

Now many of the financial media pundits are making their own predictions...

But ultimately, only one industry will decide the fate of the markets.

And it decides tomorrow.

It's All About the Banks Next Week - Especially These Two...

Earnings season is upon us once again, with many banks reporting next week. And whether or not this market rally continues really lies in their hands. In fact, bank earnings can be the most significant drivers of stock prices, which is why next week is so important. That's also why researching how well stocks have done before and after earnings is absolutely critical.

Now, I always use my proprietary tools to run an analysis of how well stocks perform before and after earnings over the past four quarters, either by the best price moves or best change in implied volatility (IV). This allows for an average view that you can use to determine how stocks will respond to the latest earnings report. But you can also find this information on financial websites that track earnings.

And based on my data, there are two stocks in particular that you'll really want to keep a close eye on: Bank of America Corp. (NYSE: BAC) and Goldman Sachs Group Inc. (NYSE: GS). Both of these companies are leaders in the financial sector and are the ones that can really set the tone for the markets when their earnings reports come out before the market opens on Tuesday, July 18.

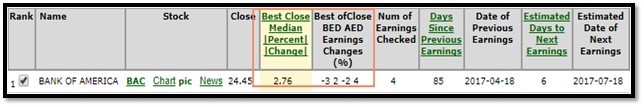

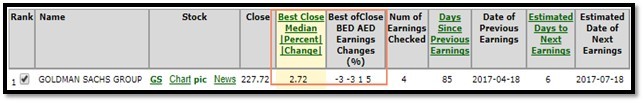

Below are the tables for the best price change in their stocks over the four days prior to earnings announcements over the last four quarters. You can see that for both stocks, the column "Best Close Median Percent Change" shows a 50/50 split between positive and negative earnings results:

BAC:

GS:

We'll need to see what comes out on Tuesday, and whether they report positive or negative earnings, to determine whether the market rally will continue.

Investors have the luxury of time when it comes to holding stocks through earnings season. But not so much for options traders.

So here's what you can do...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

How to Trade Options During Earnings Season

When it comes to your trading strategy, consider opening a long call, long put, or a straddle (which is even more conservative but increases your cost due to the buying of a call and a put - with the same strike price and expiration).

The timing of when to exit is what to decide next.

As option traders, we love to sell when implied volatility (IV) is high. And there's typically no greater catalyst for higher IV than the expectation of what earnings will be - usually the day of or before the announcement. So to get a better chance of selling an option at a higher price than normal, I'd consider selling before the earnings announcements are made.

It's also usually a better bet to exit the position by the closing bell the night before the day earnings come out if it's due to report before market open (BMO). If earnings are due to come out after market close (AMC), then it's typically better to exit the position before the closing bell.

The danger of holding a simple long call or long put position over an earnings announcement with the intent to exit after it comes out is that the stock could gap against you. If you are holding a long call and the stock gaps down, or if you're holding a long put and the stock gaps higher, you're at risk of losing 100% of the value of your premium (the price you paid for the trade). And that means you can say "goodbye" to the money you put down on that trade.

That's why a straddle is often times an even better trading strategy to use during earnings. A straddle allows you to hold over an earnings announcement, with the expectation of a gap higher or lower so that the long call or long put go in-the-money enough to cover the cost of the trade - and deliver profits.

Furthermore, when using a straddle, you really don't need to worry about which way the stock gaps - so long as it does. In the event that the stock doesn't move at all, then you do face the risk of neither option increasing in value. But when it comes to the split positive and negative results over the last four earnings sessions for BAC and GS, a straddle would be the better way to play the stocks. Of course, you'll want to consult your financial professional to make sure you're choosing the most suitable stocks and trading strategies.

The Gains Are Both Big and Fast: Just take a look at how quickly readers can bank their profits. Total gains of 277% in five trading days, 269% in six trading days, 221% in two days, and 297% in 24 hours. That's good enough to turn $500 in each trade into $11,855 cash a few days at a time. It's the fastest legal way to make money we've ever seen. When anything makes this much money, there's a limit to the number of readers who can see all the details. See how it all happens right here…

The post On Tuesday, This Industry Will Decide the Fate of the Stock Market appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.