You're looking at a major shift in the stock market today.

It'll happen because most investors will make a decision that they think is best for their portfolios.

But it's not.

In fact, it could be the single worst mistake they'll make this entire year - and could cost them seven months of profits.

I don't want that to happen to you.

So here's how to avoid it...

Why "Selling in May and Going Away" Is the Worst Move You Can Make for Your Portfolio

There's an old saying in the markets: "sell in May and go away." It's a common phrase that you'll probably hear the financial news pundits throw around a lot over the next couple weeks. And it's based on historical data that shows the markets perform worse between May and October (and better between November and April).

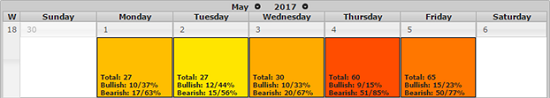

Now, it is true that the Dow Jones Industrial Average (DJIA) has only returned 0.3% on average between the May and October time frame while returning 7.5% between November and April. And here's an idea of how just the first week of May looks, according to my proprietary tools:

That's why to investors, it doesn't seem like such a bad idea to simply sell their stocks and "go away" until November.

But in actuality, it's the worst possible mistake they can make...

Just because the Dow only returns an average 0.3% over a seven-month period doesn't mean there aren't opportunities to make money. But while these gains are relatively flat, it doesn't mean there's an overall loss in the market, either. And remember... there are easy ways for you to make money in any market environment - up, down, or sideways. For example, last week I showed you two different ways to make money off of the French presidential election.

So truthfully, when you sell in May and go away, you're setting yourself up to miss out on seven months of profits.

Instead, what you can do is balance out your bullish and bearish strategies, such as using long calls and long puts on stocks. And speaking of options... here are two more strategies you can use...

No. 1: Go Bearish on the Averages

Options are available on market indexes such as the DJIA and the SPDR Dow Jones Industrial Average ETF (NYSE Arca: DIA). You can consider buying protective puts, which are simply put options that are used as a way to protect "on paper" capital losses of a stock in your portfolio. So say, for example, that you own at least 100 shares of a stock at $50. If you believe the stock will drop in price over the next seven months, then you could purchase a $50 put with an expiration in June, July, or even longer.

Let's say you purchase this put at $2.00 (or $200, since one contract equals 100 shares). You've now bought the rights to "put" this stock to the buyer at $50 (or make the market buy it from you at $50). If the stock drops to $45, then you're now in-the-money (ITM), giving that $50 put a real value of $5. And rather than sell the stock, you could sell the option for $5.00 (or $500). This means that even though the stock itself dropped to $45, you paid $200 for the put option and could sell it for $500. So you earn $300 for the option trade and still get to control 100 shares of the stock.

So that's one way to reduce your basis while bringing in capital, all while you hold the stock.

No. 2: Go Bullish on Non-Correlated Assets

A non-correlated asset is one that moves in the opposite direction of the markets or equities. These are assets that are considered "flight to safety" plays. So when equities are trending down, these types of securities will rise in price because investors tend to take their money out of depreciating assets and move it into ones that will outperform equities over a period of time.

Examples of non-correlated asset classes are gold, like the SPDR Gold Shares ETF (NYSE Arca: GLD), bonds, such as the iShares 20+ Year Treasury Bond ETF (NYSE Arca: TLT), and the currencies like the euro, such as the CurrencyShares Euro ETF (NYSE Arca: FXE).

So if you expect the markets to go down and these don't correlate, then you might consider buying calls.

Now, there is one more strategy you could use - and it's the same strategy my Money Calendar readers will be using to capture profits over these next seven months. In fact, I'll be releasing two trades on today that will follow this strategy. To learn more, just click here.

Don't Miss: Get $45,000 Worth of Our Best Stock Research for Just Pennies a Day

The post This is the #1 Mistake Investors Will Make on Monday appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.