General Electric Co. (NYSE: GE) stock has fallen 63.53% from a peak of $60.00 on Aug. 28, 2000, to a 52-week low of only $21.88 per share. Not surprisingly, millions of investors are eyeballing it thinking to themselves that it's ripe for a recovery.

Good luck with that.

The stock will have to appreciate 127.06% just to break even.

Dividend investors are at particular risk because the cash flow is so bad that executives may not be able to cover the $8 billion nut legions of retirees are depending on.

That anyone thinks this is a surprise at this stage of the game given the company's history simply boggles my mind.

General Electric is a train wreck of a stock and has been since former CEO Jeffrey Immelt took over from "Neutron" Jack Welch in 2001. At the time, he was viewed as a hero capable of running the legacy he inherited to new heights, but now, 16 years later, Immelt may go down as one of the single worst CEOs of all time.

Plenty of shareholders would agree.

GE's lost a staggering $400 billion worth of its money on his watch. I think it's very telling that GE's stock was worth less on the day he left than on the day he joined the company. And, unfortunately, millions of investors who've gone along for the ride have gotten clobbered.

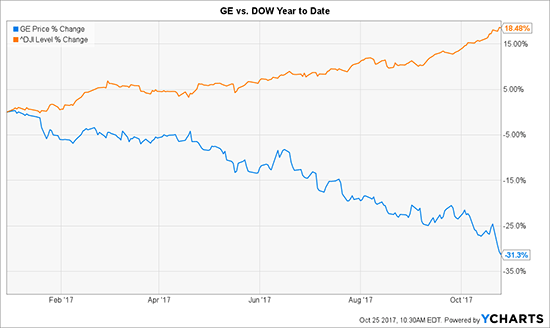

Adding insult to injury, GE's stock is off a stunning 31.3% this year alone, while the Dow has put in a staggering 54 new record highs over the same time frame.

Now What?

The Internet is filled with stories about why GE's a great buy at around $22 a share:

- "Why Now Is a Good Time to Buy General Electric" - Forbes

- "General Electric: Buy the Dip?" - Motley Fool

- "Why Dividend Growth Investors Should Consider GE" - Seeking Alpha

Don't believe a single one of 'em.

The GE we know today will not exist in 10 years... if at all.

In fact, I think it's highly likely that GE gets dropped from the Dow, which would be the ultimate irony considering that it's the only original listing left from 1896, when the Dow was created. GE is in such bad shape that it's skewing the ratio of the highest- to lowest-priced stocks in the venerable industrial index.

GE's profits have repeatedly fallen short of expectations, cash flow difficulties make a dividend cut very likely on Nov. 13, and poor management execution is de rigueur.

"But," goes the rallying cry, "it's GE!"

So?

It doesn't matter whether we're talking about an American icon or not.

I see very little evidence that GE executives understand how to move the company forward, which means, by implication, that they don't understand the markets within which the company operates. That's hardly a recipe for success... perhaps at the tables in Vegas, but that's a different line of thinking.

The irony, of course, is that Immelt wanted to create a simpler, far more valuable industrial company. Instead, he's leaving behind a ruined shell with no consumer presence to speak of, very little in the way of commercial product viability, and almost no development pipeline.

Wall Street, naturally, doesn't see things that way, which is hardly unexpected. They make their money by keeping you in the game, so publishing a positive spin is par for the course.

Again, don't fall for it; what Wall Street says is very different from what Wall Street does.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

There are 11 analysts who still rate GE a "Buy," according to Bloomberg, and I've got to believe all of 'em are willing to ride GE into oblivion. You know how dangerous that is from earlier conversations we've had about traditional analysts' desire to be right even at the expense of being profitable.

The situation reminds me of Enron, where 15 analysts covering the stock rode it all the way down from $90 a share to roughly $8 a share and a loss of 91% (right before the company disclosed that five years of earnings would have to be recalculated) before changing their collective minds. Even worse, two brokerage firms didn't downgrade Enron from a "Strong Buy" until it hit $4.14 a share!

Or International Business Machines Corp. (NYSE: IBM), which completely missed the pivot to cloud-based computing despite being in the business. It's never recovered from the erosion in its traditional software, hardware, and consulting businesses... and probably never will.

Or Sears Holdings Corp. (Nasdaq: SHLD). CEO Eddie Lampert arguably killed the company through a constantly shifting series of changes intended to reinvent the beleaguered retailer that, years ago, I called the single most dangerous stock on Wall Street when it was trading around $31.50 a share. Lampert, by the way, has reportedly pocketed millions through special financial arrangements and dividends that went to Sears Holdings and ESL Investments, even as the company continues to fail.

Contrary to what people remember of the company that promised to "bring good things to life" in the 1980s, GE is not the omnipotent conglomerate it used to be.

Rather, it's a "things and stuff" company with little more than a hope and a prayer of fitting into tomorrow's economy, barring massive changes or a complete reboot. I see it as the industrial version of Kodak, and the fact that millions of investors cannot believe GE could fail makes me think so even more strongly.

What I mean by that is that the company makes products that are arguably better suited to the America of yesterday and to its manufacturing base of 30, 50, or even 100 years ago. Not tomorrow's tech-integrated world.

GE tried to rebrand itself into a "digital" company in 2016 by making a pivot into smart sensors and other high-tech devices that were supposed to integrate with the Internet of Things and dramatically boost profits. But we wouldn't be having this conversation had that worked.

I believe savvy investors who own GE should do two things:

- Ditch GE (before it burns 'em again) using any rally as an excuse to sell into strength and get a higher price for their stock; and,

- Plow the proceeds into a far more stable and attractive alternative like Apple Inc. (Nasdaq: AAPL), which is lined up with our Unstoppable Trends, makes "must-have" products, and keeps risk to razor-thin levels.

For those investors who want to play the other side of the coin...

Try buying at-the-money put options, like the GE Jan. 18, 2019 $23 put (GE190118P00023000), that can deliver blowout profits if GE does blow up in the months ahead. Tactically speaking, you're going to be fighting Wall Street's vested interests, so tread lightly.

I suggest keeping the amount of money on a speculative trade like this one between 1% to 2% of total investable capital. Use only money you can live without because it's going to be volatile, and you may have to ride this one all the way to the proverbial buzzer like a rodeo cowboy before it pays off.

The other consideration is that you don't have to put this trade "on" all at once. Many investors make the mistake of thinking in all-or-nothing terms, but in a situation like this one, I think it's far easier and less risky to "average in" over time. That way you can use every last gasp from Wall Street as a means of maximizing your returns by taking advantage of market fluctuations between now and when the trade expires.

I'll be with you every step of the way.

Editor's Note: If you're one of the thousands of retirees across America depending on General Electric, it's time to look elsewhere. Keith wants to make sure our Members know about one of his favorite retirement investments. It's a kind of "desert island fund" he'd buy if he had to park his money in one place, "retire" from civilization for 20 years, and come back to a pile of money. Click here to learn more…

The post What to Do Right Now If You Own General Electric Stock appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.