Most investors focus exclusively on buying stocks in an attempt to capture huge returns. That's too bad, because it means they restrict themselves to half the opportunities available to them.

I bring this up because markets move up AND down, which means there is plenty of profit potential to be had in both directions.

George Soros, for instance, is reported to have made $1 billion in a single trade that famously almost broke the Bank of England in 1992.

John Paulson made billions from the housing crisis when it hit by betting against the grain.

Doug Kass of Seabreeze Partners is famous for bucking conventional wisdom on seemingly mighty companies and laughing all the way to the bank.

That's why shorting is one of the first tactics I shared with you in my Total Wealth publication.

That's why shorting is one of the first tactics I shared with you in my Total Wealth publication.

Obviously, shorting stocks isn't for everybody - it takes a lot of guts and more than a little conviction to do it profitably. Not to mention a whole lot of discipline. But done right, it can really boost your profits.

Here's how to profit from the five scariest stocks on Wall Street... without owning them.

My Favorite Stocks to Short This Year

I've already mentioned that shorting stocks takes guts and more than a little discipline.

That's because corporate CEOs, desperate hedge fund managers, and hyper-active day traders will test your conviction and, in the process, try to make the shorting process as painful for you as it will ultimately be for them when they lose out.

Don't be put off.

Shorting, by its very nature, means you are seeing things that others are not, especially if the broader investment community is still willing to sing their praises, as is the case with every single one of my choices today.

The numbers in the five sickly stocks I've uncovered today, for example, paint a very stark picture.

That's how you know you've got a winner... because the company you're shorting is a loser.

Just take a look at the first one on my list...

Stock to Drop No. 1: Sears Holding Corp. (Nasdaq: SHLD)

It's rare to see a CEO vent his frustrations and disappointments on a blog. But on Dec. 15, 2014, that's exactly what Eddie Lampert of Sears Holding Corp. (Nasdaq: SHLD) did in his post titled "Moving Forward."

To his credit, he was upfront about the brutal facts. His company had made the decision to close more than 200 stores in 2014, he said, because "Most of these stores were losing money, some for a long time."

For a company that reported $1.1 billion less in revenue in Q3/2014 than it did only a year ago, the closing of 235 stores is necessary triage. The operating loss of $490 million that was reported for the same quarter puts further pressure on Lampert to scale down operations.

But what's really telling about Sears' actions is that, at a time when the company is desperately seeking to start making money again, it intentionally closed down some stores that were profitable. Some of the stores were in locations that Lampert described as the "most attractive mall locations in the country." The company accepted offers to sell these few bright spots for Sears, using the money to "invest more in our transformation."

But with Q3/2014 losses totaling $548 million - making last quarter Sears' 10th straight quarterly loss - it's unclear what is being transformed in the company besides its leadership. On Dec. 26, E-Commerce Chief Imran Jooma resigned from his position - or was asked to leave - with no official reason for his departure made public by the company. But his departure comes as Sears is consistently outmaneuvered in the e-commerce department by rivals like Wal-Mart, Target, and Amazon.

Being outhustled on the digital front even as it struggles with its problems in real estate, Sears is fighting (and losing) a two-front war. And the fact that Mr. Lampert openly compared his business to the death of landline phones is hardly something that inspires confidence. At least to me, anyway.

With that comparison, though, I'll admit Mr. Lampert could well be one of the most honest CEOs in America. Unfortunately, what we're seeing from his candor (not to mention the too-awful-to-spin numbers coming out of quarterly earnings) gives me more than enough reason to urge readers not to touch this stock for the foreseeable future.

Stock to Drop No. 2: Big Lots Inc. (NYSE: BIG)

Big Lots Inc. (NYSE: BIG) has a lot in common with Sears. Both of them are Fortune 500 retail companies with strong presences in the lower 48 states and in Canada. And with some 1,400 stores, Big Lots' presence in North America is comparable to that of Sears.

Big Lots also happens to be in a world of hurt, but for a slightly different reason.

While what passes as good news for Sears these days is that the company is taking in water at a rate that doesn't seem to be getting worse over time, Big Lots has come upon its problems relatively recently.

The company's Q2/2014 earnings report offered a rare bright spot to its investors as it showed revenue growth of 1.2% - tiny, but a landmark for a company that was desperate to end a streak that saw falling same-store sales for an alarming eight consecutive quarters.

If there was any hope for a change in BIG's fortune following those numbers, the Q3/2014 report put them to rest.

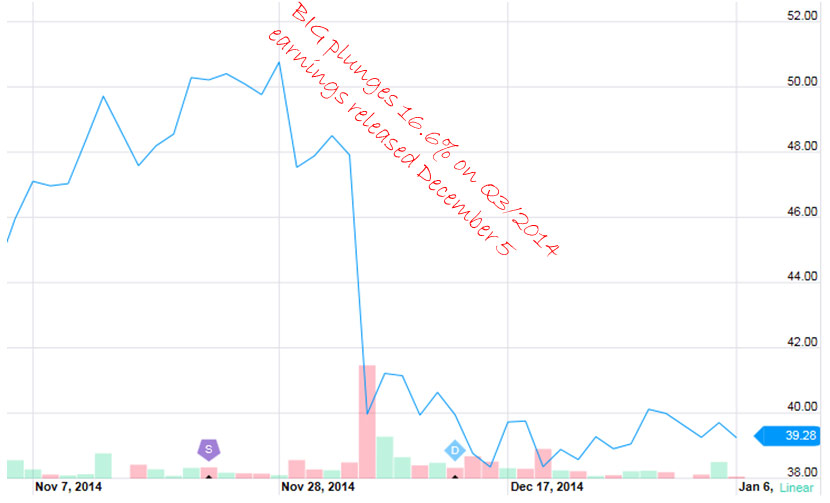

BIG stock plunged almost 17% in a single day on the news that the company suffered a loss of $0.06 per share from continuing operations, 50% higher than what the company had previously forecast. A 0.2% increase in net sales was a let-down for investors hoping the company had turned a corner.

The fall also came on heavy volume, with many more shares changing hands than do on average trading sessions for BIG. In fact, the 9.3 million volume of trading on December 5, the low point of BIG's collapse, was almost 18 times greater than the volume BIG stock reached on November 28, when it reached a 2014 high of $50.80/share.

Ordinarily, I'd be tempted to think like a contrarian here, but I won't for two reasons.

First, BIG doesn't fit into any of our "Unstoppable Trends." It's a retail company - a broadline closeout retailer to be precise - and while those can sometimes profit handsomely, they can never set you on the path to Total Wealth.

Second, the stock's fundamentals simply don't justify the valuation. BIG still has a long way to fall.

It still boasts a market capitalization of $2.46 billion, thanks to a modest rally in mid-January that partly balanced the 22% haircut it suffered in late 2014. Its P/E ratio of 24.36 is about average for the retail industry - but still outrageously high when compared to larger rivals like Costco, which showed 16% year-over-year growth in earnings per share in its last quarterly earnings report. That's in sharp contrast with the staggering 25.9% decline in income from continuing operations that BIG reported year-to-date in its Q3/2014 report.

That's a stark statistic - and it's the chief reason that the stock bled 22% of the company's market capitalization on the news of the earnings report. To make matters worse, BIG CEO David Campisi doesn't seem to get it, remarking, "I'm pleased with the results we reported today." I'd hate to see what upsets him if I were a shareholder.

With an out-of-touch CEO, stagnant earnings, and a ten-quarter record of being outworked by its competitors, Big Lots is a stock to avoid in 2015.

Stock to Drop No. 3: Sony Corp. (NYSE: SNE)

Sony Corp. (NYSE ADR: SNE) made the news for all of the wrong reasons in late 2014. First, it proved almost unbelievably vulnerable to a cyberattack that garnered international attention.

Some thought that the controversy over the hackings (reportedly ordered by the vengeful North Korean government) might actually boost "The Interview" to the point where it became a bonanza for Sony. I was never of that opinion, and made note of such on CNBC's closing bell during one of my weekly appearances saying that the once-proud brand was "lost."

Online sales were good, actually historic at $31 million, but an anemic $2.8 million from theatrical releases have made Sony's profits well below the $44 million it spent producing the film.

Even if it had performed well (and Sony may yet break even on the movie), a blockbuster still wouldn't be able to undo or even mask Sony's long-term problems.

Now, you might be asking why Sony doesn't fit into our unstoppable Technology trend. After all, it dabbles in a broad array of electronic devices - most recently a $1,200 Walkman.

But the devices that Sony produces are specialty products - expensive devices that consumers turn to only when they can afford luxuries. Worse, Sony insists on sticking to proprietary software and operating systems for many of its products at a time when devices are becoming system agnostic. For that reason, it's a market that's vulnerable to disaster and downturns, and therefore not a part of our six trends.

And Sony isn't even waiting for a downturn to show signs of trouble. The company's nominal 1.8% growth in sales reported in its quarterly earnings last October is actually a 2% decrease when calculated on a constant currency basis - something a lot of analysts who cheer Sony are missing.

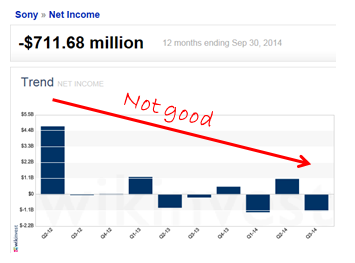

Despite a recent 12% dip, Sony is coming off of quite a run, gaining 30% in the last 12 months and outperforming the S&P 500 over the same time period. But the run has inflated the stock to a market capitalization it doesn't deserve thanks to some chilling trend lines in its net income over the last year. 2014 year-to-date net income for Sony stood at negative $711.68 million, dashing investors' hopes that the company had turned a corner with above-water Q2/2014 numbers.

Sony's promising Q2/2012 is a distant memory as these kinds of deficits have become the new norm. This steep decline in net income, coupled with a steadily diminishing earnings per share, makes Sony a stock to shun this year.

Stock to Drop No. 4: BlackBerry Ltd. (NYSE: BBRY)

Sony may have come out of the hacking scandal totally diminished as a brand, but its embarrassment actually gave BlackBerry Ltd. (NYSE: BBRY) a rare chance to shine.

That's because the company swiftly offered old BlackBerrys to Sony after their landlines and computers went down and their company email was rendered holey-er than Swiss cheese.

It was a shrewd move that wasn't entirely rooted in altruism - the donation was great advertising for BlackBerry and CEO John Chen's efforts to focus on the security that BlackBerry offers to customers. Unfortunately, the public relations coup had a very dark lining, if you look closely.

To be able to offer these phones, BlackBerry had to delve deep into their storage, digging up phones that had been presumed to be put to rest forever. Of course, that's a natural consequence of losing vast amounts of market share (BlackBerry's share of the global phone market is under 1%), and this situation is unlikely to improve anytime soon.

This collapse in market share at the hands of rivals like Apple and Samsung is the chief reason that BlackBerry, priced at $138/share just seven years ago, has been below $20.00/share since October 2011. To be fair, Mr. Chen shows every sign of understanding the gravity of the situation, and devoting the resources he can to turn things around.

But he's looking for solutions in the wrong places.

The rollout of the BlackBerry Passport Trade-Up program in late 2014 has been nothing if not ambitious. Hoping to convert some of Apple's loyalists, BlackBerry offered iPhone owners the chance to receive $550 in rewards for trading in their old iPhones. BlackBerry is even targeting the 128 GB iPhone 6!

The promotion is lasting until mid-February, but already the outlook isn't good. For all of its recent problems with innovation, Apple actually has a fantastic record when it comes to maintaining customer loyalty. Morgan Stanley's 2014 investigation on mobile market share found that a staggering 90% of iPhone users stay with Apple while upgrading their phones.

So a tough nut to crack, but points for trying? Not exactly. BlackBerry just isn't paying enough attention to recent history in the mobile sector, which is replete with failed trade-in tactics. Microsoft offered a $200 incentive last September for Apple customers to trade in the iPhone 4s, iPhone 5s, and iPad devices. The effort backfired, and Microsoft saw its share of the global smartphone market plummet by 20% in Q3/2014.

This bad precedent is clear evidence to me that BlackBerry isn't on the offensive in the continuous scramble for market share - they're just desperate. Much as they'd like to, BlackBerry can't simply write off smartphones, since more than 91% of its Q3/2014 revenue came from service subscriptions and handset sales. But service and handset revenues are already slipping, having declined by 12% year-over-year in the last quarter.

No wonder the company reported a 3.4% loss in revenues year-over-year last December. And by the way it's flailing today, I have to imagine they know they're about to lose even more.

Stock to Drop No. 5: Twitter Inc. (NYSE: TWTR)

We've already talked about why Twitter Inc. (NYSE: TWTR) represents one of the most promising profit opportunities in social media today - if you're into shorting stocks.

The company hasn't delivered on its promise to grow its user base exponentially, and to compound that problem, it's struggling to monetize the users it has.

The most interesting question that has arisen about Twitter since our shorting recommendation is the question of which will see the bottom fall out from under it first: Twitter stock, or embattled CEO Dick Costolo. Naturally, he's come under fire for the sluggish user growth, monetization struggles, shuffling of management, and the head-scratching sin of selling Twitter stock even after it had already fallen by 17% following a dismal earnings report.

Money madman Jim Cramer said it best:

Whether the CEO can hang on is the only real suspense there is about this stock. At around $37.50/share, it's still a great sell opportunity.

Editor's Note: Shorting is a great tool for your investing arsenal... but lightning-fast winners can't be discounted. Keith's very first recommendation to his Total Wealth readers saw gains of 100% within six weeks, and he still foresees plenty more upside. For a free report on the stock, including the ticker symbol, click here to sign up for Total Wealth - it's completely free.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.