Yahoo stock has slipped 3.1% this month, despite starting December with good news on its mobile ad efforts...

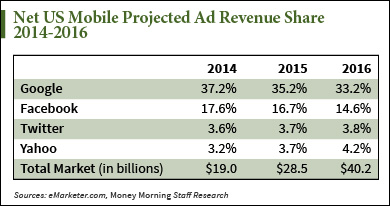

On Dec. 4, research firm eMarketer announced it expects Yahoo! Inc. (Nasdaq: YHOO) to soon overtake Twitter Inc. (NYSE: TWTR) in mobile ad market share. This should happen in 2015 and Yahoo will hold this spot in 2016.

Last year, Yahoo was an almost negligible player in the mobile ad market. This year, it actually entered the fray, capturing 3.2% of that market. This beats out Pandora Media Inc. (NYSE: P), YP.com, and Apple Inc. (Nasdaq: AAPL), which have 2014 market shares of 3%, 2.7%, and 2.6%, respectively.

In 2015, Twitter is projected to have 3.69% of the market share, while Yahoo will have 3.74%.

This report bodes well for Chief Executive Officer Marissa Mayer.

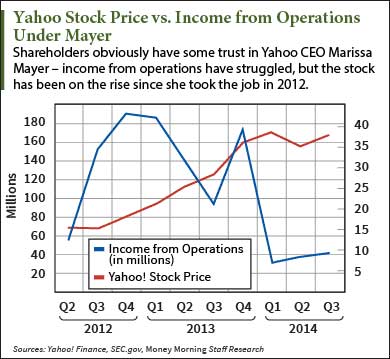

Improving the display ad business in mobile and video is among Mayer's key growth initiatives for Yahoo. It's part of her turnaround strategy for Yahoo's struggling core business - something she's been working on since she took up the lead role in 2012.

Improving the display ad business in mobile and video is among Mayer's key growth initiatives for Yahoo. It's part of her turnaround strategy for Yahoo's struggling core business - something she's been working on since she took up the lead role in 2012.

On Oct. 30, Mayer made a big move for mobile when she hired Lisa Utzschneider of Amazon.com Inc. (Nasdaq: AMZN). Utzschneider was AMZN's vice president of global advertising sales. At Yahoo, her new role is senior vice president of advertising technology and strategy.

Mayer also made a $640 million purchase on video ad platform Brightroll last month.

This is also good news for Yahoo shareholders. It means Mayer's strategy seems to be working, at least a little bit. This jump in mobile ad revenue signals that Yahoo is capable of orchestrating some semblance of a turnaround, no matter how small that may be.

And as the chart shows, shareholders have not bailed on Mayer, given that the stock has been on the rise since she stepped in despite a disappointing earnings picture.

The bad news is that Yahoo may have to settle for third place.

You see, even if Yahoo does beat out Twitter, it still sits behind - way behind - the two competitors who have always been a headache...

Yahoo's Tough Mobile Ad Competition

That's right, solidly holding first and second place are Google Inc. (Nasdaq: GOOG, GOOGL) and Facebook Inc. (Nasdaq: FB).

Yahoo's initial troubles in the ad business came from its struggles to keep up with these two behemoths.

True, Google and Facebook are losing market share in the mobile ad space. Not because they're in trouble, but the market is maturing. The market share is growing and many of the smaller, lesser-known players are gaining.

It's also because in years past, Google so masterfully and aggressively pursued mobile ad initiatives that the company's market share was unsustainably high. In 2011, Google held a ridiculous 62.5% of net mobile ad revenue share.

Yahoo is obviously chipping into this, with its 3.2% clip. But Facebook's current share at 17.6% will be very difficult to overtake. And Google's 37.2% will be near impossible to challenge.

Yahoo is obviously chipping into this, with its 3.2% clip. But Facebook's current share at 17.6% will be very difficult to overtake. And Google's 37.2% will be near impossible to challenge.

At the current pace projected by eMarketer, it would take until 2022 for Yahoo to overtake Facebook. It would take until 2028 to knock off Google. And that's under the very unrealistic assumption that Google and Facebook won't stabilize their falling market share and stay No. 1 and 2.

Try as she might, it's likely Mayer won't push past No. 3 on this one.

But she is showing signs of pushing as high as possible. And the best news is that Yahoo still boasts its main share-price driver for 2015...

The Key Reason for Yahoo Stock's Value

For now, the biggest reason to hold Yahoo stock remains its 15% stake in Chinese e-commerce giant Alibaba Group Holding Ltd. (NYSE: BABA).

"Yahoo as a standalone business is just about worthless. I've felt that way for long time," said Money Morning Chief Investment Strategist Keith Fitz-Gerald. "But that doesn't mean the company is worthless. The value infused by the Alibaba deal is a huge windfall for Yahoo shareholders and Yahoo management."

He added, "Whether or not Yahoo can actually grow its business remains to be seen."

Yahoo's stake in Alibaba is worth about $42 billion. This compares to Yahoo's own market cap of around $47.5 billion.

And with Yahoo poised to offload those shares in the coming years, shareholders stand to gain. Not only because the dollar amount will likely grow as Alibaba does, but because Mayer has a good track record on this.

In a former sale, Mayer promised $3 billion in buybacks. She delivered more than $7.7 billion.

Mayer is building out growth areas, and she is delivering to shareholders. And this news of sudden relevance in the mobile ad business can only really help Yahoo's case at this point.

Stocks to Buy in E-Commerce: When you think e-commerce, you think Amazon. You think eBay. Just recently, Alibaba surely came up on your radar with its blockbuster IPO. But here's one you may not have thought of, and why it's a buy...