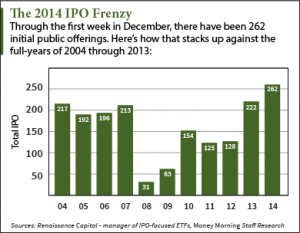

IPOS 2014: Initial public offerings this year have hit record territory. Through the first week in December, 262 companies have raised $82.1 billion through initial public offerings - the largest annual total in the past 10 years. In fact, 2014's IPOs have more than doubled the yearly average of $38.6 billion.

The IPOs of 2014 have also offered a variety of opportunities for investors to get in on potentially lucrative new stocks.

The IPOs of 2014 have also offered a variety of opportunities for investors to get in on potentially lucrative new stocks.

Some have nearly tripled from their IPO price. Although not all are winners - some have lost half their initial value.

Take a look at how these popular IPOs have done so far...

IPOs 2014: Winners and Losers

Vivint Solar Inc. (NYSE: VSLR) - The designer and installer of affordable solar solutions went public Oct 1. The recent IPO raised $329.6 million by offering 20.6 million shares at $16 per share. Vivint Solar is listed in the New York Stock Exchange under the ticker VSLR. The stock is down to around $8.30 per share.

FMSA Holdings Inc. (NYSE: FMSA) - The sand-based proppant solutions provider went public Oct 3. The company raised $400 million by offering 25 million shares at $16 per share. FMSA Holdings is listed on the New York Stock Exchange under the ticker FMSA. The stock trades around $7.19 for a more than 50% loss from its IPO price.

HubSpot Inc. (NYSE: HUBS) - An exciting recent IPO, the cloud-based marketing and sales software provider went public Oct 9. The company raised $125 million by offering 5 million shares at $25 per share. HubSpot is listed on the New York Stock Exchange under the ticker HUBS. The stock is up to $35.04 for a 40% gain from its IPO price.

Anchor Bancorp Wisconsin Inc. (Nasdaq: ABCW) - The savings and loan holding company started trading Oct 22. The company raised over $9.7 million by offering close to 400,000 shares at $26 per share. Anchor Bancorp Wisconsin Inc. is listed on the Nasdaq under the ticker ABCW. The stock is up to $31.97 or about 23% higher than its IPO price.

Money Morning Members - keep reading to see the stock that's up 199% from its IPO price. Non-Members, sign up now for free full-site access...

Dave & Buster's Entertainment Inc. (Nasdaq: PLAY) - The leading owner and operator of casual dining and entertainment venues across Canada and the United States started trading Oct 10. The company raised over $94.1 million by offering 5,882,353 shares at $16 per share. Dave & Buster's is listed on the Nasdaq using the ticker PLAY. The stock is up to $23.63 or 47.6% higher than its IPO price.

Shell Midstream Partners LP (NYSE: SHLX) - The owner and operator of oil pipelines and other midstream assets went public Oct 29. The company raised $920 million by offering 40 million shares at $23 per share. Shell Midstream Partners LP is listed on the New York Stock Exchange under the ticker SHLX. The stock is up to $34.18 - about 48% higher than its IPO price.

Boot Barn Holdings Inc. (NYSE: BOOT) - The western and work-related footwear, apparel, and accessories retail chain went public Oct 30. The company raised $80 million by offering 5 million shares at $16 per share. Boot Barn Holdings is listed in the New York Stock Exchange under the ticker BOOT. The stock currently trades around $22.20, up 38.8% from its IPO price.

Atara Biotherapeutics Inc. (Nasdaq: ATRA) - This 2014 IPO - a clinical-stage biopharmaceutical company - hit the market Oct 16. The producer of therapeutics raised $55 million by offering 5 million shares at $11 per share. Atara is listed on the Nasdaq under the ticker ATRA. It's up a whopping 199% to $31.84 per share.

More on IPOs: There are 119 companies in 2015's IPO pipeline already - but not all are going to be good investments. We got a head start on the analysis and looked at the five biggest IPOs to watch in 2015. Be prepared for next year's new stocks with this 2015 IPO preview...