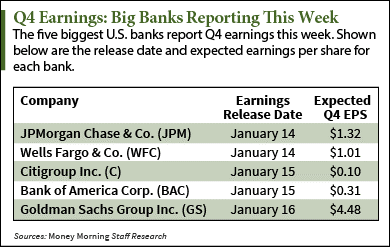

Bank earnings for Q4 will top headlines this week when the nation's five biggest institutions deliver reports.

First up are JP Morgan Chase & Co. (NYSE: JPM) and Wells Fargo & Co. (NYSE: WFC) on Wednesday. Analysts expect earnings per share (EPS) of $1.32 and $1.01 respectively. That's down $0.08 and $0.01 year over year (YOY) respectively.

First up are JP Morgan Chase & Co. (NYSE: JPM) and Wells Fargo & Co. (NYSE: WFC) on Wednesday. Analysts expect earnings per share (EPS) of $1.32 and $1.01 respectively. That's down $0.08 and $0.01 year over year (YOY) respectively.

Next are Citigroup Inc. (NYSE: C) and Bank of America Corp. (NYSE: BAC) on Thursday. Wall Street looks for Citi to report EPS of $0.10. That's down sharply from $0.77 in the year-ago quarter. Analysts expect BofA to increase EPS by $0.02 YOY to $0.31.

Goldman Sachs Group Inc. (NYSE: GS) earnings come out Friday. Estimates are for EPS of $4.48, down from $4.60 the year before.

Profit forecasts for the finance sector have fallen overall since Q4's start. At present, analysts project a 1.7% slump in sector earnings for the October-December period. That's well below the 8% growth rate forecast at the end of September, says FactSet.

Five possible factors are behind this slump. Here's a look at what will weigh on Q4 bank earnings.

Five Factors Weighing on Big Bank Earnings for Q4

No. 1. Oil Prices: Plunging oil prices have put a damper on one of banks' most lucrative segments since the recession. With interest rates near zero for six years, U.S. banks have lent often to the nation's energy sector. In fact, robust activity from energy firms offset the slack from consumers and other companies reluctant to borrow. But crude prices are down some 60% since June. That's below levels needed for some energy companies to service their massive debts. This has slowed borrowing and lending but increased default risks. The energy banking boom is over, at least for now.

No. 2. The U.S. Dollar: The strong U.S. dollar is another potential headwind for bank earnings. A strong dollar hurts U.S. exporters. With more than 70% of the world's purchasing power located outside the United States, many American companies have become exporters in hopes of tapping that lucrative market. A stronger dollar likely forced many U.S. bank customers to pull back business expansions. Plus, many banks are also exposed to higher loan losses when overseas business is lost. Finally, a strong dollar puts pressure on the U.S. Federal Reserve to keep interest rates low. That pressures banks' net interest margins - the difference between what banks can charge on loans and earn on other investments.

No. 3. Low Interest Rates: Net interest margins have declined since 2010. BofA Chief Executive Officer Brian Moynihan said on a July 16 conference call that the "sustained low-rate environment" was weighing on the bank's revenue and earnings. Moreover, if short-term rates stay low and long-term rates rise, as expected, that could curtail profits further. That's because many bank loans are tied to shorter, floating rates, according to Sandler O'Neill & Partners. While higher long-term rates allow banks to invest excess cash at more attractive yields, loan pricing is "the bigger factor" for bank profits.

No. 4. Mortgage Lending: Low interest rates did indeed spur mortgage activity over the last several years. But the mortgage business is now slowing. For the week ending Jan. 2, total mortgage application volume slipped 9.1% from two weeks earlier, according to the Mortgage Bankers Association. Applications to refinance existing mortgages decreased 12%. Mortgage applications to purchase a home fell 5%. "Beyond the seasonal slowdown, purchase application volume remains about 8% below last year's level, indicating that homebuyers are still cautious," the MBA said in a statement.

No. 5. Legal Claims: U.S. and EU banks shelled out $60 billion to settle legal claims in the first nine months of 2014. That's up from $46 billion in 2013, $44 billion in 2012, and $22 billion in 2011, according to Boston Consulting Group. Much of 2014's legal settlements were billion-dollar fines over shoddy mortgage securities sold in the lead-up to the financial crisis. Banks also faced scrutiny last year for currency and interest rate trades, where allegations of manipulation led to more sizable fines. While U.S. banks have settled the bulk of claims arising from pre-financial crisis mortgages, Boston Consulting Group says potential litigation risks remain "substantial."

Don't Miss Today's Top Story: The 2015 Consumer Electronics Show last week in Las Vegas showcased dozens of amazing new products and technologies. But the hugest buzz surrounded one trend in particular. Here's how to profit from one of the hottest tech trends of 2015...

Related Articles:

- CNBC: Weekly Mortgage Applications Fall Sharply over the Holidays

- The Wall Street Journal: High Litigation Costs: The New Cost of Banking

- New York Times: As Oil Prices Fall, Banks Serving the Energy Industry Brace for a Jolt