Last week's second-quarter earnings report from Microsoft Corp. (Nasdaq: MSFT) disappointed Wall Street and plenty of other investors - and they punished the company by slashing MSFT stock by 10% in one day, on Jan. 27.

However, that just makes the Microsoft story - which I began two weeks ago - more interesting.

Investors overreacted to what was actually a pretty good earnings report - no surprise there. And Wall Streeters, who should know better, are missing a big part of the Microsoft story - this isn't the same complacent, one-trick Windows/Office-rooted enterprise it was not too long ago.

The tech giant has been quietly and steadily rebuilding, repositioning, and refocusing itself for success in a brand-new era through big investments - and rapidly increasing sales - in hot sectors like cloud computing.

To see why this is happening, we're going to take a look at how Microsoft exemplifies Rule No. 1 of my tech wealth-building system - "Great companies have great operations."

Thanks to its visionary new CEO, Microsoft is far from being a "weak" company - and MSFT stock is due for a pretty quick rebound.

Today I'll show you why that's true - and then I'll show you why we can expect even greater gains from there...

The New Guy at Microsoft (Nasdaq: MSFT)

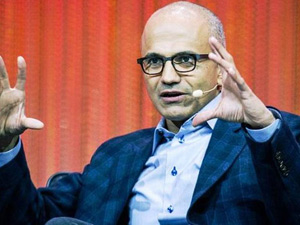

As he completes his first year as CEO, Satya Nadella has shown he has the right leadership skills to run the world's largest software firm.

As he completes his first year as CEO, Satya Nadella has shown he has the right leadership skills to run the world's largest software firm.

It's hard to imagine that almost exactly a year ago Wall Street was hoping that Microsoft's board would turn to an outsider to replace Steve Ballmer.

Under Ballmer, Microsoft missed several big shifts in the tech landscape. Most notably, the firm basically was a no-show in the hyper-growth worlds of mobile and cloud computing.

Put that into a deeper perspective. When Ballmer took over from Bill Gates in January 2000, there was no iPod, iPhone, or iPad from Apple Inc. (Nasdaq: AAPL).

Amazon.com Inc. (Nasdaq: AMZN) mostly sold books and had not yet become the nation's dominant provider of cloud computing services. And Netflix Inc. (Nasdaq: NFLX) was just getting started - as a DVD rental firm - nothing close to the king of streaming online video it is today.

Google Inc. (Nasdaq: GOOG, GOOGL) was just getting started as well, and there was no Facebook Inc. (Nasdaq: FB) or social media.

As these new tech leaders rose to power and saw their stock prices climb, Microsoft was stuck in neutral - or worse.

In the 10 years before Nadella took the CEO reins, Microsoft's stock advanced just 33%. Compare that with a 56% return over the same period for the Standard & Poor's 500 Index - and a 93% gain in the tech-centric Nasdaq Composite Index.

No wonder many industry analysts clamored for new blood at the top - someone from outside the company. On Jan. 15, 2014, USA Today quoted IDC Analyst Al Hilwa as saying:

"There is an element of the selection process to do with perceptions. The company has to show that a new leadership is unconstrained in setting new directions. This is most convincingly done with an outsider."

While Microsoft didn't end up turning to an outsider, Nadella turned out to be the right executive at the right time.

Here's why...

A Natural Leader

From Feb. 4, 2014, when the board appointed Nadella CEO, until Jan. 15, the stock was up 25%, or roughly double the S&P 500′s 13% return over the period.

Nadella brings an international perspective to his job as well as a fascination with high-tech and mental challenges.

The 47-year-old executive was born and raised in India. And that makes him the most powerful Indian-born executive in U.S. business today.

He's also one of the few American CEOs who follows the sport of cricket, which is popular in India and other former members of the British Empire. He played the sport in high school and passionately follows it to this day.

In fact, Nadella credits his high school cricket matches with his success in business. His official Microsoft biography quotes him as saying, "I think playing cricket taught me more about working in teams and leadership that has stayed with me throughout my career."

He married his high school sweetheart roughly 23 years ago, and the couple has three children. Nadella has a master's in computer science from the University of Wisconsin and an MBA from the University of Chicago.

And he still has a hunger for learning. Most mornings, he spends around 15 minutes studying an online course, pursuing subjects like neuroscience not for credit, but just for his own improvement.

And as you might imagine, the head of a huge global software firm loves to study "code." But in this case, it's not software he's talking about - but poetry.

He follows both American and Indian poets and says that poetry is a great form of "compression." Poets are the great code warriors of the world, he says, because they boil down messages that might take pages of prose to just a couple of lines.

After grad school, he joined the technology industry by taking a job at Sun Microsystems Inc. Three years later, he left the world of hardware for a career at Microsoft.

Joining Microsoft in 1992, Nadella quickly established himself as a tech leader who was also an expert in management and finance.

But much more importantly, he showed a willingness to challenge Microsoft orthodoxy. And it's that ability to take a fresh perspective that is the biggest factor in his success at Microsoft, where he is hugely popular with the workforce.

Here's a good example. While running the sprawling division that includes cloud services, he allowed outside developers to use non-Microsoft programming languages, ones that are popular with younger coders.

Former employees have told the media that decision was considered "heretical" at Microsoft's headquarters in Redmond, Wash.

But going bold paid off. Forrester Analyst Ted Schadler told The Wall Street Journal that Nadella boosted sales and secured capital to build computer server farms that support the company's now-growing cloud business.

"He's clearly a change agent," Schadler told the paper.

Last year, Nadella announced that Microsoft will cut its workforce by 18,000, a 14% reduction that is the largest in the company's history.

Most of the job cuts came out of the sprawling Nokia Corp. (NYSE ADR: NOK) phone unit, a business Nadella inherited from Ballmer as part of a $7.2 billion merger the company recently completed.

These changes recently helped Microsoft's market cap pass that of Google's for the first time since June 2013. It's now $337.34 billion compared with $210.38 billion for Google.

And that's not the only place Microsoft is growing.

A Cloud-High Bounce

With Nadella at the helm, Microsoft is quickly gaining traction in what I referred to as "legal 'steroids'" a couple of weeks ago - the cloud computing sector.

It's a huge opportunity: Market researcher Forrester estimates the cloud market will grow from $55 billion in 2014 to $241 billion by the end of the decade.

In the second fiscal quarter, Microsoft said that commercial cloud revenue - which includes Office 365, Windows Azure, and Dynamics CRM - rose 114% from a year ago. That means we're looking at an annual run rate of $5.5 billion for the company's commercial cloud.

The problems in Microsoft's second-quarter results came in the Windows sector, where revenue declined 13% year over year.

But the bottom line is solid, with the company earning $0.71 per share on revenue of $26.5 billion, slightly beating analyst estimates.

In other words, Microsoft is seeing some problems with Windows - but the cloud is turning it into a profit machine.

And the company's insiders certainly see a "bargain basement" buying opportunity here - and so should you, whether you're coming in fresh or picking up some shares on the dip.

On Jan. 28, following the earnings report, Charles W. Scharf, a member of Microsoft's board, acquired 23,612 shares at an average price of $42.34 per share - for a total value of $999,732.08.

When it comes to beaten-down stocks - and Microsoft is down nearly 18% from its $50.04 peak - insider buying is basically the single-best "Buy" signal you're going to find.

So, I'm looking for Microsoft to reach back to $50 within the year - and to start heading to $60 pretty quickly after that.

And it's all because Microsoft, now for the first time in nearly 15 years, is a clear Rule No. 1 winner.

The New Capital of the Global Auto Industry Is Silicon Valley... the advanced technology embedded in today's vehicles is among the biggest driver for sales of new cars and trucks. A recent survey revealed in-vehicle technology is the top selling point for 39% of new car buyers. Here's a company on the cutting edge of this field...

About the Author

Michael A. Robinson is a 36-year Silicon Valley veteran and one of the top tech and biotech financial analysts working today. That's because, as a consultant, senior adviser, and board member for Silicon Valley venture capital firms, Michael enjoys privileged access to pioneering CEOs, scientists, and high-profile players. And he brings this entire world of Silicon Valley "insiders" right to you...

- He was one of five people involved in early meetings for the $160 billion "cloud" computing phenomenon.

- He was there as Lee Iacocca and Roger Smith, the CEOs of Chrysler and GM, led the robotics revolution that saved the U.S. automotive industry.

- As cyber-security was becoming a focus of national security, Michael was with Dave DeWalt, the CEO of McAfee, right before Intel acquired his company for $7.8 billion.

This all means the entire world is constantly seeking Michael's insight.

In addition to being a regular guest and panelist on CNBC and Fox Business, he is also a Pulitzer Prize-nominated writer and reporter. His first book Overdrawn: The Bailout of American Savings warned people about the coming financial collapse - years before the word "bailout" became a household word.

Silicon Valley defense publications vie for his analysis. He's worked for Defense Media Network and Signal Magazine, as well as The New York Times, American Enterprise, and The Wall Street Journal.

And even with decades of experience, Michael believes there has never been a moment in time quite like this.

Right now, medical breakthroughs that once took years to develop are moving at a record speed. And that means we are going to see highly lucrative biotech investment opportunities come in fast and furious.

To help you navigate the historic opportunity in biotech, Michael launched the Bio-Tech Profit Alliance.

His other publications include: Strategic Tech Investor, The Nova-X Report, Bio-Technology Profit Alliance and Nexus-9 Network.