The Winklevoss Bitcoin ETF (BATS: COIN) is a proposed exchange-traded fund that will buy and hold Bitcoin to back the shares investors have purchased.

If approved by the U.S. Securities and Exchange Commission, the Winklevoss Bitcoin ETF - officially known as the Winklevoss Bitcoin Trust - will provide retail investors with an easy way to add Bitcoin to their portfolios.

Although unusual, in that it is based on a digital currency and not a physical commodity like gold or oil, the Winklevoss Bitcoin ETF will nevertheless be structured in very much the same way.

The Winklevoss twins, Cameron and Tyler, have said on multiple occasions that their fund is modeled on the SPDR Gold Trust ETF (NYSE Arca: GLD). With the SPDR Gold Trust, the fund buys and holds physical gold to back the shares investors have purchased.

Each share will represent approximately 1/100 of a bitcoin. According to the most recent amended S-1 filing, the Winklevoss Bitcoin Trust plans to sell 10,000,000 shares at $10 each.

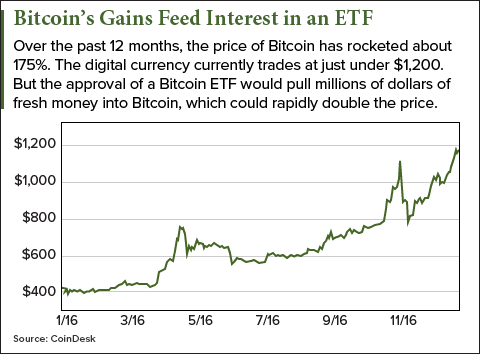

The offer price will probably need to rise to match the rising Bitcoin price, though. If Bitcoin is trading at $1,200, the offer price will rise to $12. But if the SEC approval news touches off a fierce rally, as most expect, the price of Bitcoin could double prior to the IPO.

That means we could see a Winklevoss Bitcoin ETF offer price as high as $20 or $25.

Of course, many investors are most interested in when they'll be able to actually buy shares of the Winklevoss ETF.

It could be sooner than you think...

When to Expect the Winklevoss Bitcoin ETF

The SEC has until March 11 to approve or deny a rule change that would allow the Winklevoss Bitcoin ETF to have an initial public offering (IPO) on the BATS BZX Exchange.

The rule change is required because Bitcoin is a cryptocurrency. Until now, no one has ever tried to launch an ETF based on a digital commodity.

SEC approval would end a journey that started in July 2013, when the Winklevoss twins filed the first version of their S-1 form.

Special Report: Cannabis Is The Gold Rush of the 21st Century - 30 Stocks to Invest in Now

Should the Winklevoss ETF win SEC approval, the IPO process will start. Still, it will take several months before the actual IPO occurs. But unless unexpected complications should arise, SEC approval will result in a Winklevoss Bitcoin ETF IPO by summer or fall.

The actual IPO is likely to cause another spike in the price of Bitcoin. That's because the Winklevoss Bitcoin ETF is expected to attract as much as $300 million in its first week, according to an estimate by Needham & Co. analyst Spencer Bogart.

Bogart is pessimistic about SEC approval, however, putting the odds at less than 25%.

But several factors suggest the odds of the Winklevoss Bitcoin Trust getting SEC approval could well be much higher...

Why the SEC Would Approve the Winklevoss Bitcoin Trust

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

If the SEC does approve the Winklevoss Bitcoin ETF before March 11, it will be a first for the United States, but not the world.

Two Bitcoin exchange-traded notes (ETNs) have been trading on Nasdaq's Nordic exchange, based in Stockholm, since May 2015. The fact that these Bitcoin ETNs have been operating successfully for nearly two years should ease some of the SEC's concerns about approving an ETF based on a digital currency that's only existed since 2009.

The SEC was also thought to be worried about the largely unregulated Bitcoin trading in China - about one-third of global volume. But in January, the People's Bank of China imposed new regulations that restricted margin trading as well as high-frequency trading.

Another argument against SEC approval has to do with how the daily price of the ETF is set. In the S-1 filing, the Winklevoss Bitcoin Trust said it plans to use the 4:00 p.m. auction price on the Gemini exchange - also owned and operated by the Winklevoss twins.

But that may point in favor of approval. The proposal to use Gemini to determine the NAV (net asset value) of each share did not appear in the S-1 until Amendment No. 6, filed last June - two years into the process. The decision to use Gemini, which meets all U.S. regulatory requirements, was likely done to ease SEC concerns.

And finally, the Winklevoss Bitcoin Trust has filed a flurry of updates with the SEC just since Jan. 1, including a ninth amendment to its S-1 on Feb. 8, and two updates to its free writing prospectus (Feb. 9 and yesterday).

With the approval deadline so close, a series of last-minute tweaks make little sense unless the SEC is seriously considering giving the Winklevoss ETF the green light.

Up Next: Can't wait for the Winklevoss Bitcoin ETF? There are other ways to invest in Bitcoin if you're willing to make a bit of effort. Here's everything you need to know about buying bitcoins...

Follow Money Morning on Facebook and Twitter.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.