Picking up where we left off in Part I...

It's one thing to contribute your data as part of a service like Facebook or Instagram, for example, where you're using a product based on its input and therefore enjoying a more tailored web experience.

It's another thing entirely to be the product... and involuntarily, at that.

That's the case for 143 million Americans who had their most personal information stolen in what will go down in history as one of the biggest and most expensive hacks of all time.

What's happened to Equifax's databases goes far beyond simple data theft.

As I noted in my last column, the situation creates an ongoing nightmare for millions of American consumers that could last for years to come.

That's why it's important you protect yourself and your money now.

Equifax, unfortunately, doesn't want to make this easy.

The company's website stinks. What's more, it's clearly written by corporate lawyers who appear more interested in protecting Equifax's interests than yours.

I doubt very seriously they give a damn about what's happened let alone how their mismanagement has impacted millions of consumers who implicitly trusted them to protect intimate details of their financial lives. That means you've got to take matters into your own hands.

So, before we go any further, let me tell you how you can simply, easily, and effectively protect your hard-earned reputation and your money.

You can't change your Social Security number, so that's out.

Same thing for trying to notify the various institutions housing your data because you have no way of knowing just who has what at this point because Equifax (and the other two big credit reporting agencies) have sold it to who knows how many companies along the way.

Grow Your Money with These Tips: Want an extra $1,200... $4,700... $6,500 or more in your retirement account? Boosting your savings is easier than you think. Read more...

What you can do, though, is "freeze" your credit.

If you've never heard the term before, that's a process that creates a permanent hold on your credit files that prevents the credit bureaus from releasing your credit to any company except those that you specifically designate (or those that already have you as a customer), law enforcement and the court system, or specific government agencies under the terms of the Fair Credit Reporting Act.

Credit companies like Equifax, incidentally, hate this because it means they cannot make money off your information. So they'll do everything they can to convince you that this is difficult and a pain in the keister.

In reality, it's very simple.

The process should take about 15 minutes per company and I think provides enormous peace of mind.

Here are four links I found to help you get started:

- Equifax: https://www.freeze.equifax.com/Freeze/jsp/SFF_PersonalIDInfo.jsp

- TransUnion: https://www.transunion.com/credit-freeze/place-credit-freeze

- Experian: https://www.experian.com/freeze/center.html

- Innovis: https://www.innovis.com/personal/securityFreeze

Now, let's get back to your money and to your investments.

How This Affects Your Money

Despite the fact that we've talked about it for years, most investors still have no idea just how critical big data is, let alone what a colossal opportunity it represents.

The only downside is that most of the companies tapped into this lucrative sector are also some of the most expensive... Amazon.com Inc. (Nasdaq: AMZN), Alphabet Inc. (Nasdaq: GOOGL), and Facebook Inc. (Nasdaq: FB) come to mind.

That's why I recommend 26(f) funds, and the T. Rowe Price Blue Chip Growth (TRBCX) in particular, as a "backdoor" play into some of these holdings.

A few more data thefts a la Equifax is all it'll take to bring Big Data to the forefront.

Breaches may cost the world $2.1 trillion a year by 2019, according to a recent Juniper Research report. That is, incidentally, four times the estimated cost of data breaches in 2015, just two years ago.

Keep in mind, that's just the stuff we know about.

I think the figure may be as high as $4 trillion, and I say that based on a joint survey conducted by PricewaterhouseCoopers, the U.S. Secret Service, CSO Magazine, and CERT - the DOD-funded cybercrime research center at Carnegie Mellon University.

It found that 43% of 562 survey respondents indicated that their organizations had been attacked at least once within the past 12 months, which implies that a whopping 57% either don't want to admit it or don't know they've been hacked.

Criminals press this advantage because they can.

Simply put, that means the problem will get worse before it gets better. It also means that individuals, companies, and entire countries will spend whatever they must to protect themselves.

I believe we are talking about one of the greatest single monetary gold rushes in recorded history given the speed at which technology is growing.

To put this in perspective, annual IP traffic will hit 3.3 ZB a year, or roughly 278 exabytes a month by 2021. In 2016 those figures stood at 1.2 ZB and 96 EB per month, according to Cisco. Data speeds will double by then as well.

A single ZB is equivalent to one sextillion bytes. That's roughly equivalent to every person on Earth tweeting for 100 years continuously or 125 million years of your favorite one-hour television show... and, remember, we're talking about more than three times that figure!

So now what?

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

There's no question that data security qualifies as an Unstoppable Trend within technology, nor is there any doubt that the world will spend trillions making it happen and keeping it safe.

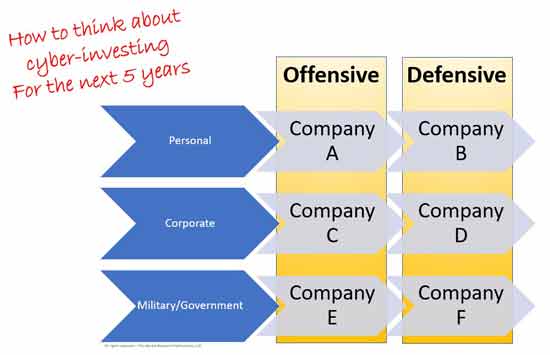

I suggest you group your thinking around a decision matrix involving two "lines of thought" for lack of a better term, one of which is offensive and the other of which is defensive. Then, cross that with functional concentrations delineated by who's involved.

Here's what that might look like:

Obviously, this is a simple framework, but it's a valuable start, especially if you haven't yet given this sufficient thought or if you've been throwing darts against the wall like most investors who were caught flat-footed by the Equifax breach.

Now, get to work filling it up.

A company like Raytheon Co. (NYSE: RTN), for example, goes in "F" because it's a large defense contractor making all manner of defensive weapons, including some really innovative cyber defense technology not the least of which includes something it calls "cyber reasoning systems" - meaning technology that's self-healing and self-adaptive in real time - to identify and uncover system vulnerabilities and also improve national security.

Investors who are following along in our paid sister service, the Money Map Report, are "up" a stunning 366% to date and in a position to capture still more profits.

On the other hand, a company like the tiny innovative defense provider that I'm recommending in this month's Money Map Report issue goes in "E" because of its ability to take the fight to the enemy while also protecting frontline operational troops against counter-cyber operations.

As you might imagine, I've got other recommendations positioned in each of the key areas. However, I need to hold specific names back today to be fair to members of our paid services.

In closing, we've obviously just scratched the surface today. That's why we're going to continue this conversation every chance we get.

Sadly, I don't believe we're going to be lacking material.

Just this morning, for example, I was reading about how North Korean hackers are targeting at least three South Korean cybercurrency exchanges using spear phishing techniques and dispersed malware to obtain Bitcoin and other electronic money that will help evade sanctions.

The regime has already been linked to malware found in South Korean ATMs, according to The Wall Street Journal, which is significant because that means Kim's henchmen can convert Bitcoins to real money, or vice versa, or into half a dozen other hard-to-track cryptocurrencies.

Equifax is only one of dozens of attacks to come and, as nasty a thought as that may be, it's also a sign of tremendous opportunity.

Opportunity I will do my very best to make sure you capture.

Editor's Note: "Must-have" companies backed by Unstoppable Trends are a cornerstone of Keith's wealth-building strategy. But there's another type of investment he wants Money Morning Members to know about. It's one of his favorites, a kind of "desert island fund" he'd buy if he had to park his money in one place, "retire" from civilization for 20 years, and come back to a pile of money. Click here to learn more…

The post Part II: What to Do (and Which Stocks to Buy) to Immediately Protect Your Money appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.