Our best stocks to buy now list for June is heavy on tech. That makes sense, of course. As Money Morning Director of Technology & Venture Capital Research Michael Robinson tells us, the road to wealth is paved with tech.

Our Money Morning investing and trading experts have picked four companies we like right now. Two of them have their feet in both the high-tech pharmaceuticals game and the more vanilla (but profitable) consumer products sector.

Our Money Morning investing and trading experts have picked four companies we like right now. Two of them have their feet in both the high-tech pharmaceuticals game and the more vanilla (but profitable) consumer products sector.

A third has cornered the market in next-generation orthodontic devices, giving it a potential customer base of 10 million teenagers and young adults.

And the fourth takes advantage of the competitive battlefield over the Internet of Things, which is set to drastically reshape the tech business (and our lifestyles) in a few years.

Finally, we pick a retail stock that (like most retail stocks today) you should stay far, far away from. Or better yet, you should profit from its impending demise.

So let's get to it. Here are our best stocks to buy now (and one stinker to short).

Best Stocks to Buy Now: Wall Street's Nail-Biting Has Turned This Goliath into a (Profitable) Underdog

Our first pick is a "gentle giant" that's been in business since 1886. It's weathered the Great Depression and a handful of banking crises before and since. It runs more than 250 subsidiaries, selling consumer products that generate $12 billion a year in revenue from 175 countries.

We're sure you've heard of it. You've almost certainly used its products, from Band-Aids, to Tylenol, to Acuvue contact lenses.

But you might not know that the company's real growth comes from its pharmaceuticals division, which rakes in $32 billion a year.

We're talking about Johnson & Johnson (NYSE: JNJ). This blue chip stock isn't exactly flying under the radar. But that doesn't mean it's not undervalued.

JNJ has recently made substantial investments in its pharmaceuticals pipeline. Most notably, in January the company beat Sanofi SA (NYSE: SNY) to buy a stake in Swiss drug company Actelion. The pairing is a perfect match, as it bulks up Johnson & Johnson's pipeline, and gives Actelion the reach of a global powerhouse.

As of May, Johnson & Johnson is expecting to launch at least 10 new blockbuster drugs in the next four years. That would add to an arsenal that already includes big sellers Remicade and Xarelto, which generate $8.2 billion and $5.4 billion a year, respectively.

First-quarter earnings grew 8.9% over the previous year and continued a six-year streak of beating consensus estimates.

And in May the stock increased its dividend for the 55th consecutive year.

But some have shied away from JNJ stock because of some one-time write-offs that cut into profits. And Johnson & Johnson gets overlooked because it's been around so long. Buying its stock is about as exciting as buying Listerine or Lactaid (both JNJ products).

But between its rock-solid consumer products and medical equipment divisions and its robust pharma pipeline, Johnson & Johnson is a great foundational investment, landing on our best stocks to buy list for June.

Best of all, according to Michael Robinson, it's selling at a discount. Here he explains how you can benefit from Wall Street's JNJ screw-up.

Best Stocks to Buy Now: This Company Lets You Rake In Cash from High-Tech Pharmaceuticals, and Also Toothpaste

For pharmaceuticals companies, diversifying into more reliable areas such as consumer healthcare can be a smart play.

The boom-and-bust cycle of prescription drug manufacturing can make investors grit their teeth. Enormous amounts of money go into research and development on drugs that only have a 1-in-5,000 or worse chance of going to market.

Moreover, the political climate is not particularly friendly to drug manufacturers right now. Americans want to see prescription drug prices go down, and many politicians - including U.S. President Donald Trump - have been sympathetic to that view.

BREAKING: New Legislation Could Turn Tiny Pot Stocks into Millions. Click Here...

That's probably why our next pick has spent the last few years rounding out its portfolio with a more reliable stable of products.

GlaxoSmithKline Plc. (NYSE: GSK) is the sixth-biggest drug maker in the world. But in 2015, it announced a major deal with Novartis AG (NYSE: NVS), selling its cancer drug portfolio and taking on Novartis' vaccines business. GSK also took over part of Novartis' consumer healthcare unit - products like toothpaste, aspirin, and nasal spray.

In March of this year, GSK's board selected Emma Walmsley as the new CEO. Walmsley came from the consumer healthcare department and before that had a background in cosmetics. That may be a clue into where the company wants to focus its efforts in the coming years.

That said, GSK is not giving up on developing pharmaceuticals. However, Walmsley has said she wants to limit pharma research to focus on the "biggest opportunities."

Michael Robinson welcomes GlaxoSmithKline's shift in focus and expects 20% growth over the next year or two. Get his expert take on why he thinks GSK is "on track to remain a major player in cutting-edge life sciences."

Best Stocks to Buy Now: This Company Gives Its Customers and Its Investors a Reason to Smile

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

If consumer healthcare doesn't excite you, dental technology may put you to sleep faster than nitrous oxide. But, as investors, there are plenty of reasons to pay attention to this area of tech.

While healthcare can be a shaky area to invest in amid so much political uncertainty, spending on dental care tends to be somewhat immune from upswings and downturns. Simply put, people will pay a lot of money to get their teeth fixed, regardless of the circumstances.

Furthermore, just as people want to make their teeth look good, they also prefer to do so without the troublesome and unappealing step of orthodontic braces.

Enter Align Technology Inc. (Nasdaq: ALGN) and its Invisalign dental aligners.

Since the company started in 1997, the creation process for the aligners has shifted into the digital realm. In preparation for aligner creation, Align makes a digital model of the patient's mouth. Then an animation maps out the steps toward a perfect smile. Finally the aligners are created using 3D printers.

These plastic aligners are virtually invisible, and can be taken out for eating and cleaning.

These plastic aligners are virtually invisible, and can be taken out for eating and cleaning.

Of the 10 million teenagers and young adults who need their teeth straightened, about half of them are candidates for Invisalign. But that percentage is growing all the time. In May, Align announced that it was granted two U.S. patents for its SmartTrack clear aligner material. The company says this material applies gentler, more consistent pressure to achieve better results than other aligner material. Introduced in 2013, SmartTrack is one of the innovations that enables Invisalign to treat a wider number of orthodontic problems.

The patents join a sizable worldwide arsenal that will enable Align to dominate its market in the United States and abroad.

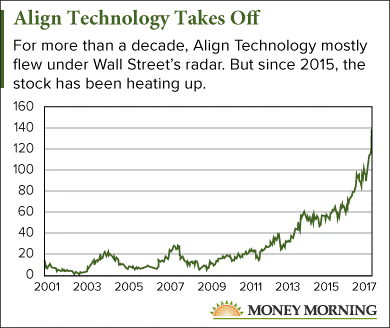

While Align's stock sputtered along for much of its existence, Wall Street has been catching on in the last couple years. The stock is up over 150% since January 2015. But Michael says the company's growth supports the rise in price. First-quarter sales hit a new record, with 208,060 Invisalign shipments. And there is still plenty of room for growth as the company spreads its reach overseas.

Here's the full story on why Michael thinks Align could bring triple-digit growth to your portfolio.

Best Stocks to Buy Now: In the Next High-Tech Race, Bet on All the Pretty Horses

If it's excitement you want, look no further than the Internet of Things (IoT), where the race for market dominance is heating up. The McKinsey Global Institute estimates that IoT could generate an $11 trillion annual economic benefit by 2025 - that's trillion, with a t.

IoT is a technology that will allow all kinds of objects to communicate data back and forth. Not just computers and smartphones, but cars, energy meters, and even people (or maybe their clothes) will be able to transmit data to improve efficiency in business and our lives.

Michael Robinson writes, "We're talking about a world in which just about every physical object... is in some way connected to the web."

No wonder companies are scrambling to take the lead in this industry.

Two companies in particular are racing each other to create the dominant cloud-based IoT platform: General Electric Co. (NYSE: GE) with its Predix platform, and Siemens AG (OTCMKTS: SIEGY) with MindSphere. Think the battle between Blu-ray and HD-DVD but with higher stakes.

GE is on the way to putting every one of its products - from lighting to appliances - online. It has even spread to aviation, where Predix can monitor conditions and flag engines for maintenance, thus reducing downtime.

Stock Talks with Bill Patalon: Why I Love GE

Instead of gambling on a winner, why not pick a whole handful of winners?

The First Trust Cloud Computing exchange-traded fund (ETF) (Nasdaq: SKYY) does just that, collecting an assortment of companies that stand to benefit from IoT's reliance on cloud-based computing. There's IBM Corp. (NYSE: IBM), whose Watson platform is already being used to improve weather forecasts. There's SAP SE (NYSE ADR: SAP), whose HANA software was instrumental in building Siemens' MindSphere platform. The ETF also includes data storage management firms like VMWare Inc. (NYSE: VMW) and data center operators like Akamai Corp. (Nasdaq: AKAM). You can buy stock in any one of these firms, or you can get a basket of them with the SKYY ETF and enjoy your front row seat as companies battle over IoT territory.

Here Michael tells us why SKYY can make you the winner of tech's biggest rivalry.

Bonus Profit Play: Short This Retail Dinosaur on Its Way Down

The Retail Ice Age has most brick-and-mortar companies closing down stores. But one outlier is taking the opposite tack. Apparently 1,154 stores in 49 states isn't enough. So this Wisconsin-based retailer has announced that it will increase its physical presence.

The move comes after the company shuttered 19 stores last year, with less-than-inspiring results. Nearby stores did little to make up for lost sales, and digital sales fell 10% in those areas.

Still, adding more stores right now reeks of reckless desperation from a dying business.

We're talking about Kohl's Corp. (NYSE: KSS). To be fair, CEO Kevin Mansell (who adds the triple-threat of president, chairman, and interim principal financial officer to his title) has committed to paring down the square footage of existing stores while adding newer, smaller stores. The idea is that more facades will keep Kohl's at the top of shopper's minds when they choose a retailer.

Don't bet on it. The problem is not that people are choosing JCPenney or Sears over Kohl's. Those companies are closing stores left and right.

The problem is that brick-and-mortar retail in general is dying a slow, painful death. Right now it's Amazon.com Inc. (Nasdaq: AMZN) versus everybody else, and everybody else is losing. In fact, Money Morning Capital Wave Strategist Shah Gilani says the Retail Ice Age is more than just a phase - it's an extinction event, "like dinosaurs dying off."

In early May we recommended Amazon as one of our best stocks to buy. But it's also worth considering shorting a dying dinosaur like Kohl's. Shares have already fallen 35% since their December high, down to below $39, but there's plenty of reason to believe they can fall further - and maybe much further.

To limit some of the risk of shorting, buying relatively inexpensive puts is another option. You can also hedge a short bet with calls at $45 or $50. That makes an already good bet a safe one as well.

Either way, when a brick-and-mortar retail CEO starts hyping their next big move, don't buy it. In every case, their days are numbered.

Find out why Shah calls Kohl's "triple-treat" CEO a triple-threat to the company.

Turn a Small Stake into a Fortune: A new earth-shattering government announcement could completely change the legalization of marijuana - forever. In fact, thanks to this historic legislation, tiny pot stocks trading for under $5 are getting set to double, triple, or quadruple. In an exclusive interview with Money Morning, pot stock expert Michael Robinson shares all the good news - including details on five tiny weed stocks that could potentially turn a small stake into $100,000. Click here to continue.