Apple Inc. (Nasdaq: AAPL) has the potential to be the first company ever to reach $1 trillion in market capitalization.

And I believe it will in a relatively short order - but it won't be easy.

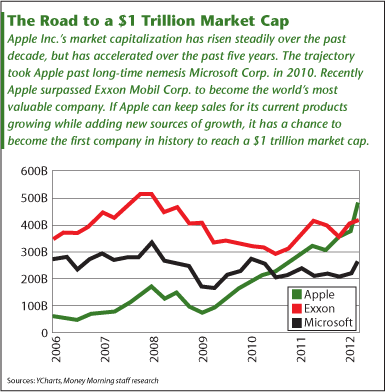

Apple took the most valuable company crown from Exxon Mobil Corp. (NYSE: XOM) in January after stunning December quarter results sent the stock soaring. Yesterday (Wednesday), AAPL's market cap crossed $500 billion.

As Apple's valuation has climbed, fueled by a five-year average annual growth rate of 59%, more people have started throwing the t-word around - as in trillion.

"Apple's a no-brainer to me to hit a $1 trillion-dollar market cap within the next year," James Altucher, managing director of Formula Capital, said on CNBC's "Fast Money" recently.

The record for market cap is just over $650 billion, achieved briefly by Microsoft Corp. (Nasdaq: MSFT) at the peak of the dotcom bubble in early 2000.

Only a handful of companies have made it to the $500 billion club, and membership has been fleeting.

The list includes Cisco Systems Inc. (Nasdaq: CSCO), Intel Corp. (Nasdaq: INTC) and General Electric Co. (NYSE: GE) - all during the 1999-2000 market peak. The last company to breach the $500 billion mark was Exxon Mobil in 1997.

One factor in Apple's favor is that it has risen to its current lofty levels not riding a bubble but despite a recession. And the markets for its existing products, such as the iPhone, the iPad and the Mac, still have room to grow.

"The reason Apple has been able to continue growing at a spectacular rate, even as its revenue base has surpassed $100 billion, is because it targets the world's biggest markets," Robert Cihra, an analyst at Evercore Partners, told The New York Times. "The simple fact is that they still have a small share of huge markets - single-digit shares in both PCs and mobile phones."

Naturally, getting to $1,000 a share and a $1 trillion market cap will require the addition of new sources of revenue, as well as sustaining growth in existing markets.

However, Apple already has head start with at least three cutting edge innovations...NFC in the iPhone

Apple already gets more than half of its revenue from the iPhone, but the addition of a new technology could add a new multi-billion dollar source of income. The technology is called

Near Field Communication (NFC), and it would transform the iPhone into a digital wallet.

NFC is a form of wireless payment that can be built into mobile devices. While not new, NFC technology has needed a major push from an influential company like Apple for it to go mainstream.

NFC is a form of wireless payment that can be built into mobile devices. While not new, NFC technology has needed a major push from an influential company like Apple for it to go mainstream.

Although NFC did not appear in the iPhone 4s, many expect it in the next iPhone refresh. And many suspect Apple has is in negotiations with MasterCard Inc. (NYSE: MA) and Visa Inc. (NYSE: V) to link credit card accounts to an NFC-enabled iPhone.

The lure for Apple is not a cut of the credit card fees, but advertising. Specifically, NFC on an iPhone would enable targeted advertising based on data collected from their actual buying habits.

That's the Holy Grail for advertisers.

"Whoever is able to do that, they will command significant streams of revenue, because that information is extremely valuable for marketers-"I spent this much and it led to this amount of sales,'" Paul Gelb, vice president of mobile atinternet marketing firm Razorfish told Mobile Commerce Daily.

Apple's legions of iPhone users, who tend to be wealthier than even other smartphone users, would be ideal targets.

"This new data and integrated [NFC-based] service offering could generate billions if not hundreds of billions of dollars in incremental ad revenue," Gelb said.

The Apple iTV

An Apple-branded television - dubbed by pundits as the iTV - would insert Apple into yet another large new market.

True, the market for televisions is mature and profit margins thin, but those have proven ideal conditions for Apple in the past.

If Apple can re-invent the television with a revolutionary interface based on its Siri voice technology and integrate it with the rest of the Apple ecosystem, it would completely upend the TV manufacturing industry.

And industry-changing products tend to add billions to Apple's bottom line.

"If Apple were to sell a TV, we continue to believe its margins and pricing could be industry leading given its vertical integration with content," Barclays Capital (NYSE: BCS) analyst Ben Reitzes wrote in a note to clients.

Reitzes calculated an iTV could contribute $5.40 of earnings per share (EPS) to Apple's bottom line in its 2013 fiscal year. Reitzes puts Apple's total estimated EPS for 2013 at $48.46.

When you multiply that by Apple's current price to earnings (P/E) ratio of 15, you get a stock price of $727 and a market cap of $677 billion. That's already beyond Microsoft's record and well on the way to the $1,000-plus target required for a $1 trillion market cap.

The iBook Revolution

Apple likes to say that education is in its DNA, so its new education-oriented initiative, iBooks 2, comes as no surprise.

Launched in January, iBooks 2 is a strategy to adapt textbooks to the iPad, starting with $14.99 high school textbooks and expanding to (presumably more expensive) college books later.

Apple has partnered with the top three textbook publishers, The McGraw-Hill Companies Inc. (NYSE: MHP), Pearson PLC (NYSE ADR: PSO) and Houghton Mifflin Harcourt, which together control 90% of the textbook market.

The publishers hope to sell more of the less expensive digital versions, which will be easier to update and will be far more interactive.

And as with music and video on iTunes, Apple will take 30% of all sales. The textbook publishers don't see this as a problem, as distribution and printing costs typically account for 25% of a paper textbook.

While not as huge as the TV or mobile advertising markets, higher-education textbook sales did rise 23% last year to $4.5 billion. A study by social learning platform Xplana predicted digital textbook sales would hit $1.5 billion by 2015, although that was before iBooks 2 was announced.

But just as important to Apple is how iBooks 2 can encourage iPad sales and give schools (and students, for that matter) another reason to stay within the Apple ecosystem. That's also why iBooks 2 is easily integrated with iTunes U, Apple's online repository of free course materials.

When you add it all up, a $1 trillion market cap for AAPL is not that far-fetched.

"There's no mathematical reason Apple can't keep growing at a premium rate for at least several more years," Evercore's Cihra told The New York Times. "At the end of the day, there's no good reason for market cap to be a ceiling."

Related Articles and News:

- Money Morning: Money Morning:

How iTV and iPad 3 Will Push Apple Inc. (Nasdaq: AAPL) Over $600 - Money Morning:

Apple Inc. (Nasdaq:AAPL): When to Buy the World's Hottest Stock - Money Morning:

Once the Planet's Most Valuable Company, Cisco Systems Inc. (Nasdaq: CSCO) Now Seeks to Rebound From a Decade of Stagnation - Fast Company:

MasterCard Emerging Payments Chief Provides More Proof Apple's Looking Into Smartphone Contactless Payments - Xplana:

Digital Textbooks Reaching the Tipping Point in the U.S. Higher Education - CIO:

Apple's iPad Aims to Revolutionize Education - Investor Place:

Pluses and Minuses in Apple's iBooks 2 Textbook Equation - Los Angeles Times:

Google, Microsoft, Apple and the race to a talking TV - USA Today:

Can Apple reach $1 trillion in market value? It's possible - The Guardian:

Can Apple become the world's first trillion-dollar company?

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.