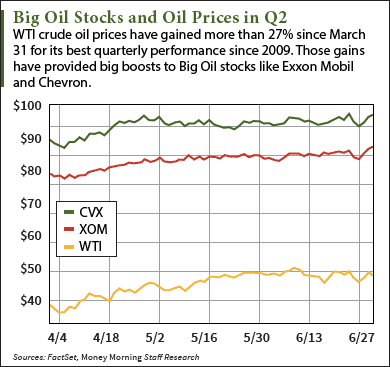

Oil stocks saw tremendous gains in the second quarter, and their performance is owed to the rebound in oil prices.

Oil stocks saw tremendous gains in the second quarter, and their performance is owed to the rebound in oil prices.

But the rally doesn't make every oil stock a buy. In fact, investors bought eight popular oil stocks that should actually be avoided right now...

You see, the 26.1% rally in WTI crude oil prices in Q2 was the U.S. benchmark's best quarterly performance since Q2 2009. These incredible gains pushed shares of supermajors like Chevron Corp. (NYSE: CVX) and Exxon Mobil Corp. (NYSE: XOM) up 9.2% and 11.3% over the same period, respectively.

This charge in the WTI crude oil price comes just four months after hitting historic lows. On Feb. 11, WTI futures closed at $26.21 a barrel - the lowest settlement since 2003.

Now that the oil market has rebounded, investors who waited out the volatility want to know if it's time to buy back into the "Big Oil" stocks. This group refers to eight of the biggest independently owned oil companies in the world...

- Chevron, Exxon, Royal Dutch Shell Plc. (NYSE ADR: A), Total SA (NYSE ADR: TOT), Eni SpA (NYSE ADR: E), BP Plc. (NYSE ADR: BP), ConocoPhillips (NYSE: COP), and Phillips 66 (NYSE: PSX).

Many investors are following analyst recommendations and heading back into these stocks. On May 18, commodity firm Argus upgraded XOM stock to a "Buy," while Citigroup Inc. (NYSE: C) recommended Eni SpA.

But we advise avoiding these massive oil stocks for one important reason...

Why You Shouldn't Invest in Big Oil Stocks Now

One reason why you should stay away from these oil stocks is their plunging profits.

Despite the recent rebound in oil prices, the 75% price crash from June 2014 to the bottom in February wrecked the balance sheets of these huge companies. They've seen big profit plunges as they burn through cash to try to maintain regular drilling operations. The annual profit of BP and Chevron fell a massive 51% and 76% last year, respectively.

This year, these oil giants are dealing with their worst earnings in over a decade. Exxon reported an adjusted profit of $1.8 billion for the first quarter - the lowest since 1999. BP posted a Q1 loss of $583 million - a staggering swing from a profit of $2.6 billion during the same quarter last year.

But Money Morning Global Energy Strategist Dr. Kent Moors says there are several other reasons why Big Oil stocks could lose you tons of money right now.

One reason concerns a bad number on their balance sheet that's increased tenfold over the last decade.

Another has to do with their questionable exploration budgets...

This is why Moors - who's worked in the global oil industry and advised U.S. and Iraqi energy agencies over his 40-year career - just recommended another way to play the recent oil price rally.

In fact, this particular investment lets you make money from rocketing oil prices without playing oil at all.

Moors recommended this stock to readers back in March. Since then, shares have surged more than 43%, and analysts say it could rally as much as 81% in the next year.

Click here and we'll immediately email you Moors' new investment report showing you how to make market-beating returns from this energy stock. You'll also receive Oil & Energy Investor briefings, free of charge.

Follow Money Morning on Facebook and Twitter.

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]