Billionaires like Frank Giustra don't waste their time on dead-end projects.

So the fact that Giustra is backing Hive Blockchain Technologies Ltd. (OTC: HVBTF), a Bitcoin stock focused on cryptocurrency mining, tells us this company has tons of potential. My research shows shares will at least double over the next 12 months.

Editor's Pick: The Best Blockchain Stocks to Buy in 2018 May Surprise You

"My primary goal and only concern is building the value of the company," Giustra told Tommy Humphreys on a post on CEO.CA. "This is typically a three- to five-year exercise and the daily share price does its thing in the meantime."

A native of Canada, Giustra is known mainly for his successes in the precious metals mining and entertainment businesses.

Giustra's financial wizardry helped turn junior miner Wheaton River Minerals into a powerhouse that Goldcorp Inc. (NYSE: GG) acquired in 2005.

In 1997 he founded film and television company Lions Gate Entertainment Corp. (NYSE: LGF.A, LGF.B).

Today Frank Giustra is chair of Leagold Mining as well as president and CEO of private equity firm Fiore Group.

But he isn't the only notable person associated with the Hive Blockchain project.

Frank Holmes, chief investment officer at U.S. Global Investors Inc. (Nasdaq: GROW), a leading mutual fund and asset-management firm, serves as chair of the company.

"Millionaire Maker": A potential upgrade taking place behind the scenes could send the Bitcoin price to unprecedented highs. Few people even know about this game-changer. Click here to learn how you could make millions...

Meanwhile, the largest shareholder in Hive Blockchain Technologies is Genesis Mining, the biggest cloud-crypto miner in the world. Genesis also operates the data centers in Iceland and Sweden where the mining takes place.

It's an impressive lineup for a company with a micro-cap valuation of just $277 million and a share price that sits in penny stock territory ($0.85 on the U.S. OTC market).

And it means Hive Technologies is a great alternative way to invest in cryptocurrency without the hassle of buying and holding any actual crypto. (Canadian investors can buy Hive on the Toronto Exchange, TSX: HIVE.)

Here's why this Bitcoin stock has attracted so many heavy hitters...

Why Winners Like Frank Giustra Are Backing Hive Blockchain

Hive has carefully planned its strategy to become a global leader in crypto mining. It intends to focus initially on mining Ethereum and Bitcoin, the No. 1 and No. 2 cryptocurrencies, although it expects to add others.

Hive has several advantages over potential rivals. Genesis Mining brings five years of Bitcoin mining experience to the project and knows how to squeeze the most profits from a mining operation.

The factors a miner can control are the availability of cheap electricity, the cost of the mining equipment, the energy efficiency of the hardware, and how well it can manage its operation.

Genesis has developed proprietary software to manage its big mining farms, which it uses in the Hive facilities. This software automates much of the mining operation, saving money and extracting the most from the hardware.

Genesis chose Iceland and Sweden because both offer very cheap electricity. Their cool climates also reduce the costs of artificially cooling the mining rigs, which generate a lot of heat.

Genesis builds its own mining rigs using off-the-shelf parts and GPUs (the graphics processors that do the actual mining) from companies like Advanced Micro Devices Inc. (Nasdaq: AMD) and Nvidia Corp. (Nasdaq: NVDA).

The cost of that hardware and assembling it in large facilities means hefty startup costs. This is Hive's most important advantage. It has access to the capital it needs to get off to a quick start...

How Hive Can Fund Rapid Growth

Hive never had an IPO, instead gaining access to the public markets by executing a reverse takeover of Leeta Gold Corp. last September. It's a common maneuver among penny stocks.

That move, the deal with Genesis, the purchase of 17 million shares by Holmes' U.S. Global Investor, and the relationship with Giustra allowed Hive to raise $147 million of growth capital in its first full quarter of operation.

With prominent investors already backing Hive, raising capital as needed should not be a problem.

And as a well-capitalized operation, Hive can do whatever it takes to get the high volume of GPUs its needs as quickly as possible (the sooner you get a GPU online, the sooner it can make money for you). That includes leasing Boeing 747s to transport the GPUs directly from the factories to the mining facilities.

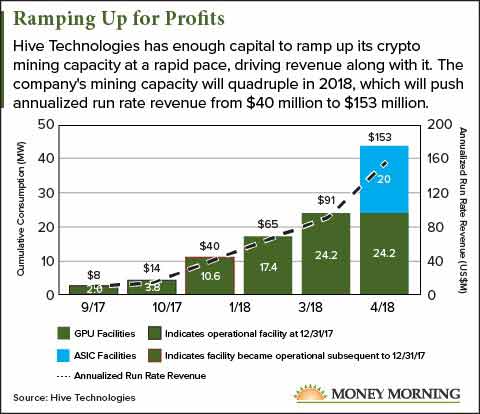

It also means Hive can scale its operations very quickly. The company launched with just 2 megawatts of mining capacity last year. It's already expanded that to 24.2 megawatts and plans to nearly double that to 44.2 megawatts by September. It has already purchased more property in Norway for future expansion.

The rapid expansion of capacity means the annualized run rate of Hive's revenue will have grown from $8 million at launch to $153 million in the company's first year.

And unlike many new companies, Hive has proven itself profitable - if only barely. In its first quarter of operation, it made $149,724.

While this Bitcoin stock is obviously high-risk because of its exposure to the volatile cryptocurrency sector, that level of risk also has the potential to deliver huge returns.

Here's what you can expect...

Why This Bitcoin Stock Will Rise at Least 250%

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Though it's less than a year old and a micro cap, Hive already has two analysts following it.

The low one-year target is $1.77, more than double the current price of $0.85. The high target is $2.97 - a 250% gain from today's price.

Of course, the profitability of crypto mining depends heavily on crypto prices. So far in 2018, crypto prices as a group are down 58% from their peak. No doubt that's hurt Hive's profitability (we don't know the numbers because the company hasn't yet reported its Q4 earnings).

But nearly all cryptocurrency experts expect a turnaround before the end of the year.

According to Finder.com's monthly survey of fintech leaders, by the end of 2018 Bitcoin will rise 95% to $14,638, and Ethereum will rise 82% to $1,045.44.

Of course, we've seen numerous Bitcoin price predictions with much higher targets. For example, Wall Street firm Fundstrat sees Bitcoin reaching $25,000 this year, $36,000 by the end of 2019, and $125,000 by 2022 - just four years away.

With Bitcoin hovering around the $7,600 level now, these targets represent massive increases in revenue for Hive. With its existing infrastructure paid for, the profits will be mind-boggling.

Of course, a collapse of the crypto markets renders all this moot. But the promise of blockchain technology strongly suggests a long-term trend of rising cryptocurrency prices.

While an exact price target for Hive Technologies is impossible to predict, it's not hard to see this stock increasing by a factor of four or five (or more) over the next two to three years.

The Shocking Reason Why We Think Bitcoin Could Hit $100,000 (and How You Could Make Millions)

Cryptocurrency legend Michael Robinson just revealed the little-known details regarding the future of Bitcoin... and why at any moment, it could be poised for a record-breaking rebound far beyond anything we've witnessed already.

Michael made a prediction about Bitcoin way back in 2013 - and folks who followed his advice stood to become 253 times richer. I'd venture to say not one in 10,000 people are aware of the massive profit potential unfolding right now.

Before the mainstream public gets any wiser, you need to see this now.

Follow me on Twitter @DavidGZeiler and Money Morning on Twitter @moneymorning, Facebook, or LinkedIn.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.