Until last year, there was little point in the average investor asking how to invest in startups. You simply couldn't do it.

But a provision in a President Obama-era law that went into place last year changed that. Now eager investors looking to get in early on "the next big thing" have an easier path to do so.

What's important to understand, though, is the road to startup profits is still very risky.

Today we outline that for those investors, to help them avoid the traps and put the odds of success in their favor...

JOBS Act Makes Investing in Startups Appear Easier

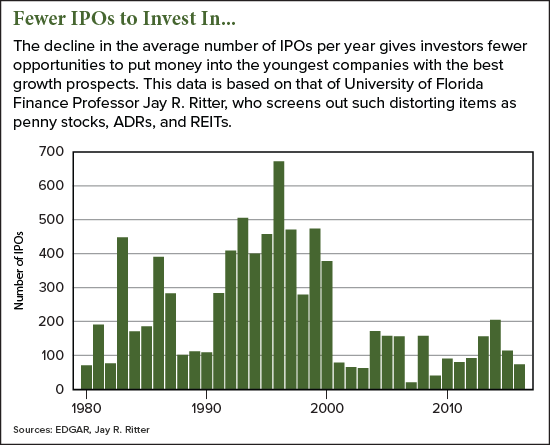

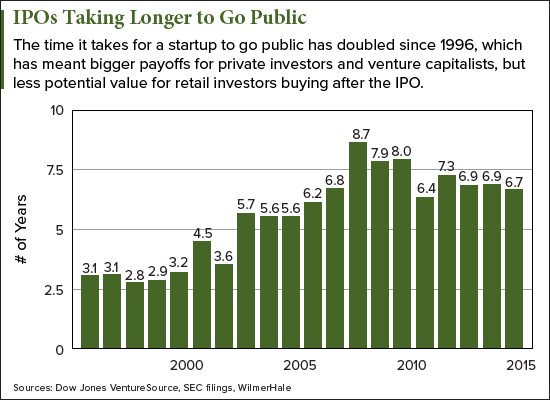

Many retail investors have craved the opportunity to invest in startups, particularly over the past 15 years. The shrinking number of initial public offerings (IPOs) and the longer periods before startups go public have deprived retail investors of a shot at the profits of promising young companies.

From 1981 through 2000, the average number of IPOs per year was 322. But since 2001, the annual average has been 108 - one-third of what it had been.

The median time a company goes before it offers shares has also increased. In 1996, a typical startup took 3.1 years before it went public. In 2015, that time had more than doubled to 6.7 years.

These shifts in the IPO landscape reserved the early, big gains for investors that had access to the most lucrative startups - venture capitalists and accredited investors (high rollers with income of at least $200,000 and net worth of at least $1 million).

Then the JOBS (Jumpstart Our Business Startups) Act of 2012 finally gave small investors a chance at bigger profits.

The JOBS Act aimed to draw more capital into young businesses to encourage hiring and spur the economy. It included a startup-related provision to let the U.S. Securities and Exchange Commission draw up rules to protect those wishing to invest in startups. After a long delay, that part of the JOBS Act finally became effective last May.

Of course, it came with a handful of guidelines for this new method of "crowdfunding," aimed to reduce the risk to regular investors...

What the SEC Says About Investing in Startups

The SEC set crowdfunding rules for retail investors, the companies seeking capital from them, and the platforms that facilitate the transactions. (Retail investing in startups must be conducted through an SEC-registered platform.) The rules include the following:

The startups:

- May raise a maximum of $1 million through crowdfunding in a one-year period.

- Must disclose certain information to the SEC and investors, including the target offering amount, the deadline to reach that amount, a discussion of the company's financial condition, financial statements, and information on the officers and directors.

- Must file an annual report with the SEC and provide it to investors.

Retail investors:

- Are limited as to how much they can invest per year. If annual income or net worth is less than $100,000, the amount permitted is the greater of $2,000 or 5% of whichever is smaller, annual income or net worth. If both are nearly equal, the amount permitted rises to 10% of the lesser amount.

- May not exceed $100,000 in total investments in startups per year.

- May not re-sell their shares for at least one year, unless the shares are transferred to the original issuer, an accredited investor, to a family member, or as part of an offering registered with the SEC.

The crowdfunding platforms:

- Must provide investors with educational materials.

- Must take measures to reduce the risk of fraud.

- Must make available information about the startup and the offering.

- Must NOT offer investment advice or make recommendations.

- Must NOT solicit purchases, sales, or offers to buy securities on its platform.

The SEC's involvement suggests that investing in startups is perfectly safe, but this type of profit seeking is still significantly more risky than investing in equities on the stock market.

Just Released: These "Second Salary" Plays Could Make You and Your Grandkids Rich

In the year since the SEC gave investing in startups its blessing, the results have been mixed...

Investing in Startups Requires More Vigilance

While there have been some success stories under the JOBS Act, bad actors are threatening to ruin it for all.

Some of those on the front lines have witnessed these abuses firsthand. Ryan Feit, the CEO and co-founder of the crowdfunding platform SeedInvest, told The New York Times in January that what he'd seen troubled him.

Feit said that SeedInvest rejects companies if he and his staff see red flags, such as an unwillingness to comply with the SEC rules.

A company named CrowdCheck has found that 40% of all startups don't get their financial results audited or certified as the SEC requires. And the SEC lacks the resources to police compliance sufficiently, leaving that up to the crowdfunding platforms.

But Feit told the NYT that he'd seen the same companies he'd rejected turn up at other platforms, where they were allowed to raise money from unsuspecting investors. One company SeedInvest rejected was able to raise $5 million before regulators shut it down as a fraudulent operation.

"I'm legitimately concerned that a lot of people are going to be losing money," Feit told the NYT. "Investing in startups is really risky, and it's very different than buying a used couch. We definitely do not think you should treat it like Craigslist."

Some of the bad sites have been taken down. FINRA (Financial Industry Regulatory Authority) closed a crowdfunding platform in December, uFundingPortal, for violating regulations.

But others haven't, which makes investing in startups something of a minefield.

We see startup investing as too risky for most investors. You can find plenty of opportunities for big gains in the more strictly regulated markets. You just need to use sound investing strategies. We have some great ideas on how to do that here, here, and here!

If you are curious enough to keep going into the wild world of startups, we suggest taking a few more steps to eliminate risk. Here are some tips to help...

How to Invest in Startups with Minimal Risk

One complicating factor to investing in startups is that you have to go beyond just researching the companies. Because not all crowdfunding platforms are following the SEC rules, you need to vet them as well - and avoid those that ignore regulations.

One great resource for those who want to invest in startups is CrowdCheck, which partners with only with crowdfunding platforms that follow SEC rules. CrowdCheck also offers reports on the startups offering shares on those platforms.

Crowdfunding platforms partnered with CrowdCheck include SeedInvest and 99 Funding. Other platforms with solid reputations include CrowdfundX, MicroVentures, and NextGen Crowdfunding.

So many choices mean investors will need to spend a lot of time hunting - remember, the nature of crowdfunding is that each company is listed only on one platform.

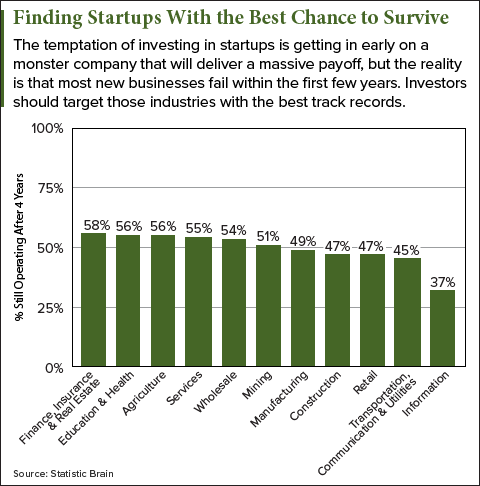

Another major consideration is the high failure rate of startups. While it's true that investing early in a successful startup will multiply your money many times over, the odds are you'll lose most or all of your capital.

Some statistics suggest the failure rate of new businesses is as high as 90%, but according to the U.S. Bureau of Labor Statistics, 50% of startups last five years or more. But investors can improve the odds by targeting industries that have had higher rates of success.

According to data from Statistic Brain, the most successful industry for startups is Finance, Insurance, and Real Estate, with 58% surviving past four years. The riskiest industry is Information, with a survival rate of just 37% at the four-year mark.

Most important of all, investors need to do their due diligence when choosing startups in which to put their money. Find out everything you can - what their business plan is, how they plan to make money, the background of the founders. You can't have too much information.

The better platforms will provide the required data - make use of it, particularly any financial statements. But don't stop there. Do some digging on the Internet as well. If you run into a lot of brick walls, consider putting your money elsewhere.

Remember, these companies are untested in the marketplace.

Penny Stock Profits: The next-best thing to investing in startups is investing in penny stocks. This investing strategy has generated total peak gains of 17,781% over the last five years, targeting little-known penny stocks backed by America's richest investors. Read more...

Follow me on Twitter @DavidGZeiler and Money Morning on Twitter @moneymorning, Facebook, or LinkedIn.

Related Articles:

- The New York Times: Doubts Arise as Investors Flock to Crowdfunded Startups

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.