For Jan. 5, 2016, here's the top stock market news and stocks to watch based on today's market moves...

How Did the Stock Market Do Today?

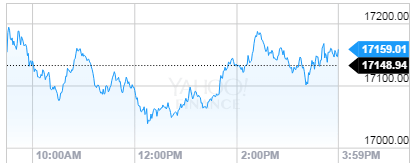

Dow Jones: 17,158.66; +9.72; +0.06%

Dow Jones: 17,158.66; +9.72; +0.06%

S&P 500: 2,016.71; +4.05; +0.20%

Nasdaq: 4,891.43; -11.66; -0.24%

The Dow Jones Industrial Average today (Tuesday) stabilized despite a 100-point drop earlier in the trading session. Markets settled on news the People's Bank of China injected roughly $20 billion into the nation's struggling financial system in order to reduce concerns after yesterday's 7% slump on the Shanghai Composite Index. That hasn't stopped many from asking one question after the Dow Jones Industrial Average's wild ride on Monday: Will the stock market crash in 2016?

Top Stock Market News Today

- Stock Market Today: Six of the 10 major S&P sectors were in positive territory today, with utilities stocks seeing the biggest gains. The Dow received a boost from DuPont Co. (NYSE: DD), which gained 1.9%. The top stock news came from Apple Inc. (Nasdaq: AAPL), which saw shares slump 2.5% after the Nikkei Asian Review reported the company will slash its iPhone production by roughly 30% this quarter. Meanwhile, shares of Ford Motor Co. (NYSE: F) and General Motors Co. (NYSE: GM) both slipped more than 1.7% after reporting weaker than expected December auto sales.

- Oil in Focus: Oil prices slid on concerns about Chinese economic data and a stronger U.S. dollar. China's manufacturing sector and a bolstered U.S. dollar offset any geopolitical concerns stemming from the break in diplomatic relations between OPEC leaders Saudi Arabia and Iran. February's WTI prices fell 2.2% to $35.97 per barrel - the lowest settlement since Dec. 21. Meanwhile, Brent oil crude - priced in London - fell 2.2% to close at $36.42. The sector's most active traders today were Exxon Mobil Corp. (NYSE: XOM) and Chevron Corp. (NYSE: CVX), which both gained 0.8% on the day.

- Gun Gains: Shares of Smith & Wesson Holding Corp. (Nasdaq: SWHC) surged 11.1% to an all-time high after President Obama announced new gun control reforms through executive orders. The company also hiked its revenue and adjusted profit projections for the current quarter and fiscal year. The company cited strong sales at the start of the annual gun show season. SWHC stock is now up nearly 180% in the last 52 weeks. Meanwhile, shares of Sturm, Ruger & Co. (NYSE: RGR) also hit a 52-week intraday high and finished up 6.8%.

- On Tap Tomorrow: On Wednesday, the markets will take a few moments away from weighing Chinese stocks to weigh in on the December ADP employment report and the minutes from the December FOMC meeting, where the U.S. central bank increased interest rates for the first time since 2006. Traders will want to know whether the U.S. economy has continued to add jobs in the private sector and whether the Fed has offered clues about any near-term rate hikes in the coming months. Companies set to report quarterly earnings include Monsanto Co. (NYSE: MON), UniFirst Corp. (NYSE: UNF), and Greenbrier Companies Inc. (NYSE: GBX).

Stocks to Watch: FSLR, GS, DIS, AMZN

- Stocks to Watch No. 1, FSLR: Shares of First Solar Inc. (Nasdaq: FSLR) surged 8% after the company received a "Buy" rating from investment bank Goldman Sachs Group Inc. (NYSE: GS). According to the analyst report, the company is set to be a major beneficiary of California's recent decision to increase its renewable energy mandate. Goldman raised the FSLR target price from $61 per share to $100.

- Stocks to Watch No. 2, DIS: Shares of Walt Disney Co. (NYSE: DIS) slipped 2% after the company received a downgrade from Macquarie Group. The investment analysts looked past recent success with the company's prized blockbuster "Star Wars: The Force Awakens" and focused on concerns about cord-cutting. The company owns ESPN, which has lost millions of subscribers in recent years as cable watchers either kick cable to the curb or downgrade service subscriptions to more affordable options.

- Stocks to Watch No. 3, AMZN: E-commerce giant Amazon.com Inc. (Nasdaq: AMZN) announced it sold more than 23 million items on Cyber Monday last year. This represents a 40% increase over the previous year. The firm also said it delivered more than one billion items during the holiday season, a 60% jump over 2014. AMZN stock was still off 0.5% on the day.

What Investors Must Know This Week

- The Best Market Crash Insurance You Can Buy

- Grab Triple-Digit Gains from This "Stealth" Tech Star

- The Real Reason for China's Insatiable Gold Lust

Follow us on Twitter @moneymorning or like us on Facebook.

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.