5 p.m. update:

Driven by big gains in cloud revenue, the 2017 Q1 MSFT earnings beat expectations and helped drive Microsoft stock up more than 5% in after-hours trading.

Microsoft Corp's (Nasdaq: MSFT) earnings per share of $0.76 easily outpaced the analyst forecast for $0.68. Revenue was $22.33 billion, which topped expectations for sales of $21.71 billion.

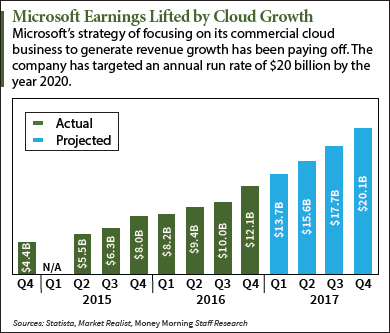

The company's cloud business had another great quarter, with revenue rising 116% year over year. Commercial cloud annualized revenue shot past $13 billion.

Revenue from Office commercial products rose 5%, with the cloud-based Office 365 seeing growth of 51%.

Windows revenue was flat, reflecting the tepid PC market.

Original story follows:

This quarter's MSFT earnings are likely to please investors, with strong numbers again expected from its growing cloud businesses.

Microsoft Corp. is scheduled to report its 2017 Q1 earnings today (Thursday) after the market close.

Wall Street is looking for MSFT earnings per share of $0.68, a slight increase from the $0.67 per share from the same quarter one year ago. The forecast for revenue is $21.71 billion, also slightly higher than last year's $21.66 billion.

A strong beat in the Q1 Microsoft earnings is a definite possibility. In the last quarter, Microsoft beat earnings expectations by 19%, propelling MSFT stock to gains of more than 9% over the following three weeks.

And the primary force that drove MSFT earnings the last time around - its growing cloud business - will play a prominent role again.

Get Our Best Wealth-Building Ideas: Money Morning's top 5 investment reports to grow your money like never before are right here - and they're absolutely free. Read more...

In the Q4 earnings in July, Microsoft's Azure cloud business grew 102%, with commercial revenue from Office 365 growing 54%. That was no anomaly. The annualized run rate of Microsoft's cloud revenue has nearly tripled since 2014.

Wall Street will be watching those businesses closely to see if the positive momentum from last quarter's MSFT earnings continues this quarter.

Based on anecdotal evidence, the odds are good that it will...

Why the Q1 MSFT Earnings Are Likely to Beat Expectations

Over the past quarter, Microsoft scored a major win with Azure in luring away Adobe Inc.'s (Nasdaq: ADBE) "Creative Cloud" business from market leader Amazon.com Inc. (Nasdaq: AMZN).

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Microsoft also deepened its relationships with partners Hewlett Packard Enterprise Co. (NYSE: HPE) and Dell Technologies. Both companies re-sell Azure cloud services and software to help drive sales of their servers.

And Microsoft announced a six-year deal with Hewlett Packard Co. (NYSE: HPQ) in September to use Microsoft's Dynamics CRM online to power its customer relations, showing that Microsoft is also aggressively going after competitor Salesforce.com Inc. (NYSE: CRM).

"Microsoft is clearly playing offense right now in cloud," Cowen & Co. analyst Gregg Moskowitz said in a research note last month.

Meanwhile, Microsoft's Personal Computing segment, which includes the Windows, Surface, and Xbox businesses, is expected to hold its own.

Windows sales, of course, have been hit in recent years by the decline in PC sales. But lower numbers here don't hurt like they used to, as Windows revenue has shrunk to just 10% of the company's total now.

If the Q1 MSFT earnings overall deliver as expected, Microsoft stock will enjoy a pop as it did in July. Although the price-to-earnings ratio is on the high side - 27.38 - MSFT is only up 3.75% year to date.

But whatever we see in the Q1 Microsoft earnings, investors need to bear in mind that this company is a long-term play...

Why Microsoft Stock Is a Buy Regardless of One Earnings Report

Under CEO Satya Nadella, Microsoft has made great progress in its transition away from the stagnant desktop-based businesses that built the company, Windows and Office, to new-growth, cloud-based businesses.

So Microsoft stock has a lot of growth still ahead of it. Current EPS forecasts have annual earnings doubling from $2.10 a share in fiscal 2016 to $4.28 a share in fiscal 2020.

That doesn't necessarily mean the MSFT stock price will double, but even at a P/E of 20, you're looking at a price of $85.60 - a gain of 48.6% over the current price of $57.60. And that's not counting the 2.5% dividend yield.

Next Up: Why the Microsoft Dividend Alone Is Reason Enough to Buy the Stock

Follow me on Twitter @DavidGZeiler or like Money Morning on Facebook.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.