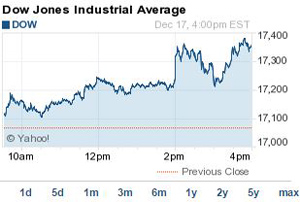

Today's Fed meeting gave the Dow Jones Industrial Average a boost. The blue-chip benchmark jumped 288 points on news the Federal Reserve plans to be patient with its timeline for raising interest rates. The markets were also fueled by a surge in energy stocks, which received a slight bump from rising oil prices and strong data from the Energy Information Administration.

The S&P 500 jumped 2% on the day, its largest one-day gain for 2014. The VIX, the market's volatility gauge, plunged more than 17% on the day.

The S&P 500 jumped 2% on the day, its largest one-day gain for 2014. The VIX, the market's volatility gauge, plunged more than 17% on the day.

Today's Scorecard:

Dow: 17,356.87, +288.00, +1.69%

S&P 500: 2,012.89, +40.15, +2.04%

Nasdaq: 4,644.31, +96.48, +2.12%

What Moved the Markets Today: U.S. stocks soared Wednesday afternoon when Federal Reserve Chairwoman Janet Yellen said the central bank plans to be patient with its possible interest rate hike in 2015. In a statement, the central bank dropped the language stating it would be a "considerable time" before the Fed engaged in a rate hike and replaced it with a suggestion that it will be "patient" when it comes to tightening policy in 2015. Here's a breakdown of the three most important things to know about today's Fed statement.

Now check out the day's most important market notes:

- Upgrade Optimism: A day after hitting a 14-month low, shares of Google Inc. (Nasdaq: GOOG) jumped 2.1% on news it received an upgrade from analysts at Pivotal Research. The optimism of a $610 price target comes a day after it was downgraded by an analyst at JPMorgan Chase & Co. (NYSE: JPM). Pivotal Research also offered an upgrade to Twitter Inc. (NYSE: TWTR) this afternoon, sending Twitter stock up 1.25%. The research firm said Twitter is improving its relationship with marketers and highlighted that the company doubled its revenue in the third quarter.

- Earnings Blowout: Shares of Oracle Corp. (NYSE: ORCL) jumped more than 3.2% after the bell today on news the company beat fiscal second-quarter earnings estimates. This was the first time that the company bested Wall Street estimates in a year. The previous three quarters saw the firm miss estimates and its iconic CEO Larry Ellison step down and relinquish his role to Safra Catz and Mark Hurd. Oracle stock is back in striking distance of its 52-week high.

- Interview Off: In a blow to Sony Corp. (NYSE ADR: SNE), more than five major U.S. theater chains said they will not be showing the studio's new James Franco and Seth Rogen film "The Interview." The news comes in the wake of a serious hacking attack against Sony and as cyberterrorists have threatened 9/11-style attacks on filmgoers. The film's plot centers on two would-be assassins who visit North Korea with the goal of killing the nation's Supreme Leader Kim Jong-Un. Shares of Sony were up on the day by 3.4%. The following chains will not show the film until an investigation of the cyberattack is complete: Regal Entertainment Group (NYSE: RGC), AMC Entertainment Holdings Inc. (NYSE: AMC), Cinemark Holdings Inc. (NYSE: CNK) and Carmike Cinemas Inc. (Nasdaq: CKEC).

- Another Shot: Shares in Herbalife Ltd. (NYSE: HLF) bounced back from session lows this afternoon and finished up 1% on the day. HLF stock slumped earlier today after Pershing Square hedge fund leader Bill Ackman took another swipe at the healthcare marketing company. Ackman predicted a "2015 event" in which the government would need to step in and address the company's practices. He also said he hopes rival activist investor Carl Icahn sells his Herbalife shares.

- Ending an Embargo: Shares of the Herzfeld Caribbean Basin Fund Inc. (Nasdaq: CUBA) hit a seven-year intraday high this afternoon, soaring 28% on optimism the United States will soon normalize relations with Cuba. President Barack Obama announced Wednesday that he has asked the State Department to renew communications with Havana and that the United States has exchanged three convicted Cuban spies for an American detained in the country. The Herzfeld fund holds stocks and other assets the manager believes would outperform the market should the United States lift its 50-year-old embargo on Cuba. Despite the optimism, investors would be wise to avoid this play due to the 29% premium the fund carries to its Net Asset Value.

Now our experts share some of the most important investment moves to make based on today's market trading - for Money Morning Members only:

- Three Tech ETFs That Will Double Your Money: Money Morning Tech Specialist Michael A. Robinson is forecasting a strong year for stocks - and especially tech stocks - in 2015. And folks who pick the "right" profit plays can do even better than the market. Here's how to grab those market-trouncing gains with three profit plays that appear tepid on their face, but are actually high-octane claims on the hottest slices of Silicon Valley growth...

- Three Scary Tech Stocks to Avoid in 2015: Just because 2015 will be a strong year for tech stocks doesn't mean every single one will be a winner in the New Year. With that in mind, let's take a look at 2015's three worst tech stocks. Tread carefully, though - their numbers may terrify you...

- One Stock That Will Profit from a New, Breakthrough Medical Direction: Modern medicine, for all of its sophisticated drugs, complex gadgets, and amazing surgical procedures, rarely cures anything. It treats. It manages. It postpones the inevitable. But return a patient to normal, optimal health? Rarely. So when an innovation comes along that can effect a complete and permanent remission of disease or restore damaged organs to a pristine state, it should cause your keenest investing instincts to perk up and pay attention...

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.