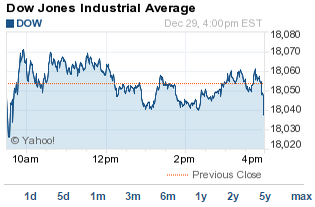

DJIA Today: The Dow Jones Industrial Average fell 15.5 points on Monday, as markets reacted to falling energy prices and renewed geopolitical concerns about the debt situation in the nation of Greece. Despite oil prices rising this morning over Libyan supply problems, prices fell sharply in the afternoon. This dragged the energy sector down in the process.

DJIA Today: The Dow Jones Industrial Average fell 15.5 points on Monday, as markets reacted to falling energy prices and renewed geopolitical concerns about the debt situation in the nation of Greece. Despite oil prices rising this morning over Libyan supply problems, prices fell sharply in the afternoon. This dragged the energy sector down in the process.

The S&P 500 Volatility Index (VIX), the market's fear gauge, jumped nearly 5% on the day.

Let's take a look at today's scorecard.

Dow Jones: 18,038.23, -15.48, -0.09%

S&P 500: 2,090.58, +1.81, +0.09%

Nasdaq: 4,806.91, +0.05, +0.00%

What Moved the Markets Today: The Dow Jones today fell slightly as oil prices reversed sharply from this morning's jump. A fire in Libya's largest export facility destroyed two days of the nation's production. However, the markets shrugged off supply concerns and priced tumbled during the session. Today, WTI oil fell roughly 2% to $53.64 per barrel for February delivery. Brent oil was down 1.5% to $57.94 in afternoon trading. Meanwhile, a snap election in Greece is likely as the nation's parliament rejected the government's presidential candidate. This has spurred concerns that the leftist Syriza party could rise to power. The faction aims to eliminate most of the nation's debt and cancel terms of the nation's bailout from the European Union and International Monetary Fund. The National Bank of Greece (NYSE ADR: NBG) slipped more than 8.5% on the day.

Here's a breakdown of today's other top stories and stock performances:

- Shake It Up: New York burger chain Shake Shack has filed for an initial public offering and will list its stock on the New York Stock Exchange using the ticker symbol SHAK. The company said it hopes to raise at least $100 million. Shake Shack has filed at a time when smaller, fast-casual dining options have fueled significant investor interest. Shares of El Pollo LoCo Holdings Inc. (Nasdaq: LOCO), Habit Restaurants Inc. (Nasdaq: HABT), and Zoe's Kitchen Inc. (NYSE: ZOES) all soared after their IPO debuts.

- The Winner Is: The International Business Times reports that Apple Inc. (Nasdaq: AAPL) was the most traded company by retail investors in 2014. Apple stock rose more than 40% this year as the company saw strong sales of its new iPhone, the introduction of Apple Pay, and a slew of new products and services. But Money Morning Tech Specialist Michael A. Robinson says investors haven't seen anything yet. Michael says the stock could rise another 27% easily for anyone who gets in right now. Read his Apple stock forecast for 2015 here.

- Auto Boom: Online auto retail firm Cars.com, a division of Gannett Co. Inc. (NYSE: GCI), said today it expects December to produce the highest level of monthly sales for light new vehicles since 2006. The firm projects sales of 1.51 million units, an 11.3% rise over the same period last year. Shares of General Motors Co. (NYSE: GM) were up 2.58% on the day, while Ford Motor Co. (NYSE: F) traded up about 0.5%.

- Commodity Forecast: Gold prices and silver prices both retreated on the day despite new concerns about another Greek credit crisis. Gold futures for February delivery slipped 1.0% to $1,183.70 per troy ounce. Silver futures for March delivery shed 2.3%, falling to $15.78 per ounce. Money Morning Resource Specialist Peter Krauth offers his take on where gold and silver prices are poised to go in 2015 with his precious metals outlook.

- Earnings Beat: Shares of LiveDeal Inc. (Nasdaq: LIVE) soared more than 19% on heavy volume and its busiest trading day since late May. The specialized marketing company reported extremely strong earnings and beat Wall Street expectations. This week is one of the quietest reporting periods of the year for the markets. No S&P 500 companies will report until next week.

Now our experts share some of the most important investment moves to make based on today's market trading - for Money Morning Members only:

-

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

Three Tech ETFs That Will Double Your Money: Money Morning Tech Specialist Michael A. Robinson is forecasting a strong year for stocks - and especially tech stocks - in 2015. And folks who pick the "right" profit plays can do even better than the market. Here's how to grab those market-trouncing gains with three profit plays that appear tepid on their face, but are actually high-octane claims on the hottest slices of Silicon Valley growth...

- Three Scary Tech Stocks to Avoid in 2015: Just because 2015 will be a strong year for tech stocks doesn't mean every single one will be a winner in the New Year. With that in mind, let's take a look at 2015's three worst tech stocks. Tread carefully, though - their numbers may terrify you...

- One Stock That Will Profit from a New, Breakthrough Medical Direction: Modern medicine, for all of its sophisticated drugs, complex gadgets, and amazing surgical procedures, rarely cures anything. It treats. It manages. It postpones the inevitable. But return a patient to normal, optimal health? Rarely. So when an innovation comes along that can effect a complete and permanent remission of disease or restore damaged organs to a pristine state, it should cause your keenest investing instincts to perk up and pay attention...

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.