U.S. companies have been piling on debt thanks to the Federal Reserve's low-interest-rate policy - and that debt is about to get painfully expensive for some...

The Fed's trend toward raising interest rates risks setting off these "debt-bomb" companies - those that have exploited low rates to borrow more than they should.

The Fed has kept rates near zero for so long - mid-2008 was the last time the fed funds rate was as high as 1%. And companies may have assumed the lending-friendly environment would last forever judging by their high rate of borrowing.

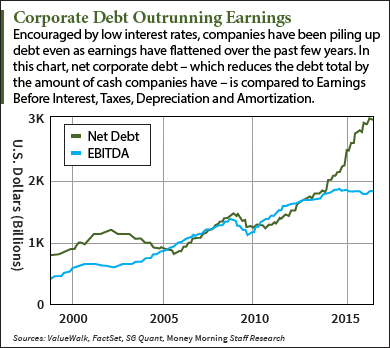

Back in 2008, U.S. corporate debt was about $3.55 billion. As of the second quarter of this year, it had grown 62% to $5.76 trillion.

Over that same span, U.S. corporate profits have risen 45% from $1.06 trillion to $1.48 trillion. And despite the low rates, interest payments are up 40% since 2008.

In other words, companies have added debt at a pace faster than their ability to service it.

"Corporations are far more leveraged than they were on the cusp of the financial crisis," said Money Morning Global Credit Strategist Michael Lewitt. "Their precarious condition is disguised by eight years of zero interest rates. Now that the Fed is contemplating raising interest rates, their disguise could be ripped off."

The danger of these corporate debt bombs is becoming more obvious even with low rates, and it's a global problem.

So far this year 122 companies have defaulted worldwide - a pace not seen since 2009.

And that's with near-zero interest rates.

Imagine how much worse the corporate debt-bomb problem will get when central banks start raising rates...

How the Fed Will Light the Fuse on "Debt Bomb" Companies

At this point it appears the Federal Reserve will lead the way in rate hikes, as the world's other major central banks show little stomach for changing course in the near future.

At this point it appears the Federal Reserve will lead the way in rate hikes, as the world's other major central banks show little stomach for changing course in the near future.

That means U.S. debt-bomb companies are in line to go off in greater numbers as the Fed tightens.

Right now the markets expect a rate hike at the December FOMC meeting. And the Fed members themselves, via the "Fed dot plot" they published in September, see interest rates rising past 1% next year, close to 2% in 2018, and past 2.5% in 2019. That's a big series of jumps from the 0.25% rate we have now.

A steady drumbeat of increases will put a lot more pressure on overleveraged companies. Not only will taking on new debt get much more expensive, so will refinancing old debt.

"Bond and bank loan investors don't want to report defaults to their investors if they don't have to. So they are perfectly content to allow borrowers to 'extend and pretend' their loans until sometime in the future when they are forced to face the music," Lewitt said.

Here are seven high-debt companies especially at risk right now...

7 Debt-Bomb Companies Dreading a Rate Hike

These companies are having trouble even with interest rates low:

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Corporate Debt Bomb No. 1: Sears Holdings Corp. (Nasdaq: SHLD)

One of many victims of the crisis in the U.S. retail sector, Sears may not make it past the December Fed rate hike, much less any future rate increases. The company has $3.5 billion in long-term debt. The debt-to-equity ratio is negative, as shareholder equity has declined to -$2.7 billion.

Meanwhile, Sears' ability to pay its debt has been racing backwards. The company reported a net loss of $398 million in the second quarter. Its free cash flow to long-term debt ratio has gone from -28.51% in 2013 (already bad) to -96% this year.

Meanwhile, Sears' ability to pay its debt has been racing backwards. The company reported a net loss of $398 million in the second quarter. Its free cash flow to long-term debt ratio has gone from -28.51% in 2013 (already bad) to -96% this year.

Wall Street smells blood, as SHLD stock has plunged 52% over the past two years.

Corporate Debt Bomb No. 2: iHeart Media Inc. (OTCMKTS: IHRT)

Like Sears, radio station operator iHeartMedia (formerly Clear Channel Communications) is struggling to cope as its business model is disrupted by technology. The company has nearly $21 billion in debt but a market cap of just $115 million.

IHeartMedia hasn't had a profitable quarter since 2007, losing between $219.5 million and $4 billion annually.

"This company has been holding on by a string: refinancing, restructuring, pushing back payments, and cannibalizing its healthier divisions to create more cash," Lewitt said. "But if rates go up, the jig will be up."

Corporate Debt Bomb No. 3: Advanced Micro Devices Inc. (Nasdaq: AMD)

Semiconductor maker AMD has long been an underdog, fighting against two much larger and deep-pocketed rivals, Intel Corp. (Nasdaq: INTC) on the CPU side and NVIDIA Corp. (Nasdaq: NVDA) on the graphics chip side.

But lately, with more than $2 billion in debt and eroding market share, AMD really has been on the ropes. The weight of its debt compelled AMD last month to issue $600 million worth of new stock, plus $700 million of convertible debt, both of which diluted equity.

For now AMD has high hopes for its new Zen processor as well as its new Polaris GPU. Whether these new offerings prove successful or not, AMD can't rest. It constantly needs to invest heavily in research and development to keep pace with Intel and NVIDIA.

When the Fed raises rates, the higher costs of borrowing will put AMD under even more pressure.

Corporate Debt Bomb No. 4: Valeant Pharmaceuticals International Inc. (NYSE: VRX)

Some see Valeant as a turnaround play, but its $31 billion in debt and legacy of bad behavior make it a poor bet.

Revenue has been falling and legal fees are eroding what profits remain. And in addition to all the debt, Valeant has $11 billion in pension liabilities, deferred tax liabilities, and current liabilities.

"VRX is heavily leveraged, has negative tangible net worth, is under investigation by multiple government agencies, and offers far more risk than reward," Lewitt said. "This company is functionally insolvent from a balance sheet perspective."

In January, Lewitt saw a profit opportunity in Valeant's woes. He recommended a trade that delivered a 700% gain in a little over two months.

And VRX stock has plummeted 86% in the past 12 months, which makes raising capital via selling new shares impractical. Given its precarious position, Valeant's higher costs from a Fed rate hike could trigger a total fiscal meltdown.

Corporate Debt Bomb No. 5: Cheniere Energy Inc. (NYSEMKT: LNG)

Cheniere's liquefied natural gas business has been hurt by low prices for that commodity. The company has made a huge, risky bet on LNG exporting, primarily via its Sabine Pass project, which finally started to generate revenue earlier this year.

"Sabine Pass is an extremely high-risk proposition that involves enormous execution risk and commodities pricing risk," Lewitt said.

Getting to this point has doubled Cheniere's debt over the past two years to nearly $18 billion. Though earnings are improving as the Sabine Pass project ramps up, they were still negative in the most recent quarter. And interest expenses of $106 million represented a whopping 60% of revenue.

Cheniere's earnings will rise as its LNG exports increase, making the interest payments more manageable. But a glut of LNG globally will keep prices down, depressing Cheniere's revenue.

Plus, the company needs to keep borrowing to finish the Sabine Pass and other LNG projects - about $2.4 billion in 2017 and $5.85 billion in 2018. A series of Fed rate hikes will make that new debt significantly more expensive.

Eventually the Sabine Pass project has the potential to be a big moneymaker, but the crushing debt and rising interest rates are likely to drag Cheniere down before that happens.

Corporate Debt Bomb No. 6: SolarCity Corp. (Nasdaq: SCTY)

On the one hand, SolarCity has seen its business boom in recent years, with installations in 2015 up 73% over 2014. But because SolarCity finances many of the residential projects it does, the company acquires debt along with sales -- and at a much faster rate.

SCTY added $140 million in debt last year - an increase of 212% over 2014. Worse yet, few investors have wanted the debt SolarCity has been selling. Rates kept creeping higher, from the 2%-4% range to 4%-5% to, most recently, 6.5%. And the terms have gotten shorter, from five- and 10-year bonds to just 18 months.

"SolarCity has been borrowing money from CEO Elon Musk and other related parties to stay alive. This is a bad sign because it means that unrelated investors are reluctant to lend it any more money," Lewitt said.

Imagine what higher interest rates will do to this already shaky financing model. And that brings us to...

Corporate Debt Bomb No. 7: Tesla Motors Inc. (Nasdaq: TSLA)

Tesla has made some impressive achievements in electric cars, but as a business it's struggling. The company loses about $19,000 on every car sold, even though they cost upwards of $70,000. TSLA recently raised $1.4 billion in cash by issuing more stock.

Lewitt criticized Tesla for using non-GAAP numbers in its earnings "to create a false picture of its financial health." He considers the company a Ponzi scheme.

So Tesla's plan to buy SolarCity for $2.6 billion (Elon Musk controls both companies, so eyes wide open) will merge two debt bombs, making the resulting combination that much more susceptible to a Fed rate hike.

"This is one of the most disastrous mergers of all time - truly a match made in hell," Lewitt said.

Next Up: It's possible to wring spectacular profits -- gains of 3,000%, 6,000% and even 8,000% -- from "debt bomb" companies if you know just how to go about it. After years of research, Michael Lewitt finally "cracked the code." And now he's ready to share it with you...

Follow me on Twitter @DavidGZeiler or like Money Morning on Facebook.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.