By Shah Gilani

Dear Red Alert Reader,

If you think the Dow crashing 1,600 points intraday was unprecedented, you’re wrong.

If you think the Dow trading 5,000 points up and down in a single day was an aberration, you’re wrong.

If you think the wild swings equity markets experienced in February will eventually pass, you’re wrong.

And if you think that volatility kills your chance to make money in the markets, you’re wrong.

Everything you’ve heard on TV and everything you’ve read about the stock market’s violent moves is wrong, for one simple reason. Hardly anyone realizes the truth, and the handful of people who do know aren’t honest about it.

I’m going to tell you something you aren’t going to hear or read anywhere else, because it’s time you know.

When it comes to volatility, I have spent decades studying its effect on the markets. As one of the traders who was instrumental in creating the precursor to the VIX – the CBOE Volatility Index, sometimes called the market’s “fear gauge” – I am unlike most “experts” who will tell you how to interpret volatility.

And, when wild swings hit markets in early February, I was constantly asked for my opinions.

What will the Dow do? Is inflation the problem? Are you worried?

To the latter, my answer to everyone who asked was the same: no, I am not worried. The Dow’s not going to hit rock bottom anytime soon and, no, inflation is not the problem.

What I’m ready to reveal to you here is something I didn’t get a chance to say on television, but still needs to be said.

The markets have become dangerous. The people in power don’t want to admit what they’ve created, and they don’t want the average investor to know what to expect. If the average investor understood what was behind the curtain, they would know how to trade the system for incredible gains.

Here’s the truth behind our new reality, and how to find major profits in the madness…

What I Didn’t Say On National Television, I’m Saying Here

I got the chance to appear on Fox Business Network’s Varney & Co. with the president of the New York Stock Exchange Group, Thomas Farley, at the very beginning of the crash. I was very curious to hear his insight.

During my Varney & Co. appearance on February 6, host Stuart Varney asked Mr. Farley if there were any problems at the Exchange. Mr. Farley replied that things were “working well,” and that, despite how wild things were, it had been an “orderly day” because no limit up or limit down circuit breakers were triggered.

Orderly. That’s an interesting way to describe this. It is true that the limit circuit breakers weren’t triggered that day, but it was only because they kick in on a huge 7% down move in the S&P 500, and we wound up down 4.5%, not 7%.

Then Stuart Varney asked Mr. Farley if the 1000-point drop was program trading- or algorithm-driven. Mr. Farley completely punted, saying, “The last day I recall with volatility that looked like that was actually the election night… If you look back to the election night and you look at where we are now, the Dow’s up 40%, unemployment is down 1%, GDP is up 1%… Markets go up, markets go down.”

So, he didn’t answer the question. For good reasons.

It was only out of respect that I didn’t dispute Mr. Farley’s contentions on live television – even though I knew that the selloff was not orderly and that it was feeding volatility.

What I wanted to do was ask him to tell Varney & Co. viewers why the venerable NYSE lets high-frequency traders co-locate their servers next to the Exchange’s servers.

I know that it’s so they can front-run investors’ orders by reading them before they’re constructed into the national best bid and offer (NBBO), but the NYSE didn’t want the public to know that. I also wanted to ask him what the Exchange was going to do to prevent 1,000-point swings the next day, or any day in the future. And, what about 2,000-point swings? Or 5,000-point swings?

Rather than challenge him with that, I started to explain what I am taking on here, only to be limited by broadcasting constraints.

So, here’s what I didn’t get a chance to say on television: the truth is that volatility isn’t causing markets to drop a thousand points in a matter of minutes, or causing the wild swings back up and then down again.

Far more frighteningly, the wild swings are a function of the market’s mechanics.

Call It the Rise of the Machines

While the NYSE isn’t solely to blame for frightening mechanics, this still poses a number of issues. All the exchanges and all trading venues – which are all electronic, despite the human traders in colorful jackets you see on TV -are to blame.

The rise of the machines is a function of competing exchanges and trading venues vying for orders, employing better and faster computers with new technologies. And the lack of honest liquidity feeds these machines like blue whales feed on krill.

Times have changed, to say the least.

The NYSE and, later, the AMEX (the American Stock Exchange) used to be the principal locations where stocks were traded in the United States, both in downtown Manhattan.

In 1971, NASDAQ was launched to trade OTC (over the counter) stocks via computer terminals.

For years, everyone kept to their turf. But the end of fixed commissions in 1975, the proliferation of computers in the 1980s, the Internet, discount brokerages, and individuals wanting to trade spawned aggressive trading venue competition.

In the late 1990s, electronic communications networks (ECNs), along with computerized trading platforms with names like Archipelago and Brut, wanted to trade NYSE stocks, AMEX stocks, NASDAQ stocks, and anyone’s stocks their public customers wanted to trade. They won the right to do just that. ECNs proliferated like wildfires in the face of Santa Ana winds.

The problem with multiple trading venues (now including exchanges like Direct Edge, BATS, and “dark pools”) all trading the same stocks is that orders to buy and sell the same stocks get spread all over the place, as opposed to all going to one location.

Back when an investor or institution wanted to buy or sell a million shares of International Business Machines Corp. (NYSE:IBM), they sent their orders to the NYSE, where everybody’s orders from around the world went.

The “specialist” at the NYSE in charge of trading IBM keeps a “book” of all the orders everyone wants to execute at whatever prices they’re waiting to get, to either sell higher or buy lower than wherever IBM is trading.

Specialists are “market-makers,” whose job is to “maintain a fair and orderly market” by offering to buy and sell stock, based on customer orders or for themselves to make a profit for their own account. In the process, they do not allow the stock to trade wildly up and down.

Now, because orders are split up across different exchanges and trading venues, no one can see all the “order flow” in one stock, and no one knows how other orders being executed elsewhere will affect prices.

Because investors and traders are quick on the trigger to cancel orders, the minute that markets start to dive, they cancel their buy orders, not knowing how low stocks could drop in a major selloff. The net effect is there aren’t many “standing orders” backed up on specialists’ or market-makers’ books.

That’s why sell orders can crash markets. There are no buy orders waiting to catch those sell orders and stocks and markets freefall.

High-Frequency Trust Falls

HFT shops exist in the space created by trading venue competition.

What their superfast computers do is read the order flow, all the buy and sell orders being sent from everywhere into exchange servers, where traders expect their orders to be posted or executed.

By “co-locating” their servers right next to exchanges’ servers (in 400,000+ square foot server parks built by exchanges to rent space to HFT shops and hedge funds for up to $25,000 a month) their computers can “see” what orders are about to get to exchanges. And, because their computers are faster than everyone else’s, they can jump ahead of those orders and execute against those orders for themselves.

These are not long-term traders. They are looking to immediately trade out of whatever position they get into, for pennies on the dollar. They do that millions of times a day, all day, every day, to highly profitable results

Except when markets go haywire.

When markets are going up, as they have been, HFT shops are proud to tell anyone who will listen that they provide liquidity and help investors execute their orders, because they’re there for them. That’s rubbish.

When markets are crashing, high-frequency traders turn their computers off. Stocks are gapping down, sometimes dollars at a time, and there’s no money to be made trying to prevent that.

Oh, they’re still watching. Their computers will see buy orders coming in, and they’ll get ahead of them, knowing that there may not be many sell orders in the pipes, and their buy orders will start lifting stocks in a vacuum of other orders. That’s how stocks bounce back hundreds of points at a time.

It’s frightening. To completely understate the issue, the market’s mechanics are faulty.

The sell triggers can be better-than-expected growth in wages, or more jobs being created, or by rising bond yields, or political triggers, it doesn’t matter. They happen.

But selling that drops markets by a thousand or two thousand points isn’t the result of some trigger or even multiple triggers. The wild drops and the swings are purely the results of the market’s current mechanics.

Don’t trust what you’re hearing from the people who call these swings “orderly.”

What Volatility Means For Your Money

If you’re going to keep your wits about you, you’ve got to understand the ins and outs of volatility as if you were on a trading floor.

Volatility is every stock, every bond, every commodity, and every tradable instrument’s constant companion, so make it your best friend.

Some investors shun volatility, while others – especially traders – seek it.

Volatility itself doesn’t discriminate. It can completely change in the blink of an eye, and then it usually reverts to its mean.

That’s the nature of volatility. Which is why it’s important to know the inherent volatility of investments you own and know how market volatility can affect your investments.

Knowing the inherent volatility, how much and how quickly the value of any investment or market increases or decreases, of anything you own can be complicated or easy.

The complicated way to know how potentially volatile an asset is requires you to do the math, the easy way is to look at how it trades over calm market periods and stressed periods.

You can really see the highs and lows and the height of the swings it makes when comparing the two periods. You can measure the swings relative to the average price over each period, and you’ll have a good general sense of how volatile that asset has been.

When you are comfortable with how inherently volatile your investments are, you’ll be ready for when they are going to be impacted by larger market forces. That, in turn, will help you make smarter buy, hold, or sell decisions.

I’ve been trading professionally for thirty-five years. And for me, the volatility of markets (as a whole, meaning equity markets, bond markets, commodity markets, currency markets, derivatives markets, etc., especially when they are highly correlated) is more important than the inherent volatility of any single investment.

Market volatility, because of its impact on sentiment, on psychology, fear, and greed, will move most assets as if they’re tied together like climbers on a steep-faced mountain, especially in stressed times.

The Origin of the VIX

The mother of all market volatility measures these days is the VIX.

The VIX measures the volatility of the S&P 500 index, and it is the volatility measure to watch. So many important equities, so many portfolios, so many asset managers, so many asset classes, are in, tied to, compared to, or correlated in some way to the S&P 500… And the volatility of that whole summation is closely watched.

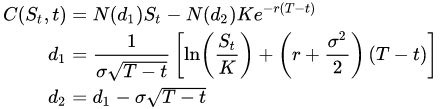

The Black-Scholes options pricing model was plugged into the computers we used at the CBOE back in the early 1980s when I was a market-maker on the floor.

If you wanted to buy or sell an option, you might look at what the theoretical price should be, to determine where you wanted to price your contract. However, what was obvious to a bunch of us was that theoretical prices derived by formula were quite different from the prices at which we were buying and selling.

Necessity is the mother of invention, and we were trying to make money. So, to find out why there was such a difference between theoretical prices and actual prices, a handful of us started playing with the Black-Scholes model.

It didn’t take us long to figure out that if we used the formula to solve for volatility, instead of some theoretical price, we got markedly different volatility numbers.

We were trying to figure out if the implied volatility that we were calculating, which represented what actual buyers and sellers were expecting and pricing accordingly (without knowing it), could help us price other options more efficiently.

It did.

I was an OEX (the S&P 100) market-maker, in the pit, trading OEX options when they were launched in 1983. A group of us immediately extrapolated out what we knew about implied volatility. We used near-month, at-the-money puts and calls (because they were the most active) on the OEX to come up with what implied volatility was on the whole market, as measured by the S&P 100.

That ended up becoming the VIX.

The VIX Does Not Predict the Future

The VIX takes prices of puts and calls on the S&P 500 and extrapolates them backward to find what the implied volatility is on all those individual options. It then weighs them to determine where the market is pricing-in volatility.

If the VIX is at 10, it means the market is pricing a potential 10% move, either up or down, in the next 30 days.

What most people miss is that implied volatility is already priced into options, because it comes from trading that has already happened. The VIX does not predict the future; it predicts what has happened, what expectations have been, and what they are currently.

If you thought the VIX was supposed to be a measure of what future volatility is supposed to be over the next thirty days, you’re partly right. It’s supposed to be but is not.

When expectations changed in early February, and panicked investors started buying puts on the S&P 500 to hedge themselves against the falling market, they bid up the price of S&P puts. That lifted the VIX, very quickly. That’s not expected volatility in the future being priced-in, that’s panic buying creating a higher VIX now, in real-time, reflecting what might happen tomorrow or any day now.

When the VIX got to 50.30 on February 6, 2018, it was because the put buying at higher and higher prices pushed it up. The VIX wasn’t saying the market expects a 50% move in the S&P in the next 30 days, even though that’s technically what it’s supposed to be saying. The “expected future” had just happened.

If the market really expected there to be a 50% move in the next 30 days, the VIX would have remained at or above 50. It didn’t. It dropped to 30 in the blink of an eye.

If you wait until the VIX is at 50 to panic and buy puts, you’ve already missed the move. Investors have already bid them up. The time to buy market protection is before the VIX rises.

The VIX should constantly be monitored. When you see volatility breaking out of a sideways pattern, that’s the time to take action.

Of course, that can get expensive if the VIX is at 10 for months (or years) on end, and you’re buying puts that you don’t need.

You can see that with the volatility index of the VIX, the CBOE VIX Volatility Index known as VVIX. It’s the vix of the VIX.

If you were following VVIX over the past months, you would have seen the volatility of the VIX picking up. You couldn’t see it in the actual VIX, which was meandering around 10, but the VVIX was moving up, signaling something was likely to happen.

Of course, it did.

Volatility is a good thing if you’re on the right side of it. In fact, volatility is an asset class all its own. You can trade volatility eight ways to Sunday if you like.

But if you don’t know the essentials of what volatility is, you might end up like all those investors who made a bundle selling volatility until February when the funds they were using imploded, taking everyone’s open positions down with them.

Luckily, there is a right way to trade volatility.

And if you understand how to trade the VIX, not only will you be able to make money from it, you’ll better understand how everything in your portfolio trades. The more you know about how things trade, the easier it becomes to make money trading them.

First, always look at the VIX as a fear gauge and a barometer of greed.

When the VIX is consistently low, especially for long periods of time (like in 2017 when it hung below 10 for what seemed like all year), it’s saying that investors aren’t buying puts on the S&P 500.

In your portfolio, you should be buying and adding to your short and long-term investment positions when the VIX is low and looks like its staying low.

But, be mindful, because volatility only sleeps, it’s never dead.

Four Ways to Profit from the Fear Gauge

Volatility can be darn complicated, so here’s what I suggest. There are only four ways I trade the VIX.

- Buy VIX Calls

I will buy VIX call options if I consider the market at risk of a sharp pullback or if I see the VIX itself becoming more volatile and expect a spike very soon.

If I’m expecting the move to happen within 30 days, I will buy call options that give me 30 days. For example, if today was March 26, I’d look at the calls that expire on April 20 or April 27.

Wherever the VIX has been trading close to for a few days or weeks, I will use as my base level. Let’s say, for example, that’s 10 points. If the base has been 10, and I’m looking for 5-10 point move in the VIX, I’d look at calls with a strike of 15 or 20. The 20 strike calls will be cheaper, so I’d probably buy those.

If I see the possibility of a sharp pullback sometime in the next few months, I will buy longer-term VIX calls. However, the longer out you go, the more expensive those calls get. I won’t go much further out than six months. If I think something could happen by then, I will look to buy six months out calls with a strike at least 20-25 points higher than what the base is today. Those will be reasonably priced because they’re 20 points out of the money today.

I’ll always put down a stop-loss order to sell half my calls when they’ve reached a 100% profit. If I get the move I expect and get taken out of half my position with a 100% gain; then I’ll put down a stop on the remainder of the position at 25% to maybe 50% lower than where I just took a profit. That way I’ll get out lower if the VIX drops back quickly, which it usually does.

I’ll keep a close eye on the remainder of the calls and sell them in a day or two if the VIX moves higher. But, I won’t hold them more than three days after a big move up. That’s typically all you’ll get out of a big VIX spike.

Another way to “see” ahead of the VIX rising is to look at big-name stocks in the S&P 500, especially the biggest-capitalization stocks, and see what’s been trending. If their volatility is increasing, if they are moving around (especially to the downside), then I’ll buy VIX calls.

- Buy VIX Puts

While the VIX is spiking and there’s a ton of fear that markets are tanking, I like to buy VIX puts.

The higher the VIX goes, the more I want to buy puts. You should be buying puts when the VIX gets to 50 every time.

When buying VIX puts during a spike, I like to buy the near-month puts with at least 20 days left because volatility doesn’t stay elevated for long periods

Because the VIX is spiking, the puts with a strike price close to where the VIX’s base has been before it spiked is what I buy. Those strike puts will be cheap because the VIX is so high.

I use the same profit-taking program when I buy puts. I use a stop to take a 100% gain on half my position and use another stop to get out of the remainder of the position if it backs up on me 25%-50%. But, because I expect a reversion to the mean, back to the VIX’s base, I will ride the remainder of my trade as long as I can.

- Combine the Two

Making money on a spiking VIX is only half the battle.

The mistake most investors make who buy volatility and see it spike is that they don’t take their profits. They see volatility rising, start profiting, think the VIX will keep going up, and usually end up missing out on most of the ride, because the VIX will revert quickly after a panic selloff. That’s why I always make sure to have my stops in place.

However, if the VIX keeps rising, I’ll ride the remainder of my position until my “gut” says I’ve made a good enough return and I’ll exit the position quickly. FYI, a 100% gain gets my gut every time. It’s never about what you make; it’s about what you keep.

Volatility tends to revert to its mean; after spiking, it settles down again.

Playing the VIX as a “reversion to the mean trade” is probably the most popular way to trade the VIX. The way to execute this trade is by buying calls because you expect the VIX to go higher and then buying puts when it spikes, to catch a profit when the VIX drops back.

Because the VIX reverts to the mean (its average), or close to where its base has been before a spike, this strategy of trading is very common and can be very profitable over time.

Buy volatility (the VIX) when it’s rising, and sell it when you’ve made your money. Roll that money into puts to make money on it reverting to its mean, and presto. You are a seasoned VIX trader.

- Trade Volatility Within Companies

Like I said before, volatility is every stock, every bond, every commodity, and every tradable instrument’s constant companion… Even within individual companies.

Many investors can be skittish when it comes to trading volatility and handling the turbulence of the market, let alone the ups and downs within a single company.

Luckily, they just leave more opportunities for the rest of us.

Plenty of people would assume you lose all your investment in the event of a company’s failure, but I found a way to make massive gains instead.

By using my proprietary “carbon trading” strategy, I’ve been showing members of my trading research service the chance for colossal profits, regardless of whether the company is going to skyrocket or plummet.

On average, 10X Trader members have been able to make 44% gains per day (including partial closeouts). That’s unlike anything Wall Street could ever promise.

I have used this strategy to produce astounding gain opportunities for my members – like the record-breaking 1,156% gains on a recent FOSL recommendation.

You read that right.

That’s not even including the 455% from AET, 324% from CHS, and the 995% from KR in potential profits. There’s no doubt in my mind that this can help you be on your way to the financial future you’ve always dreamed of.

Right now, I’m looking at an extensive list of companies to target next, and my next recommendation will be in my members’ inboxes within the next week.

In the meantime, take everything that grabby headlines and Wall Street hotshots are saying about volatility with a grain of salt. The truth is far more complicated than they want you to believe.

And remember this: there will always, always, always, be a way for you to profit.